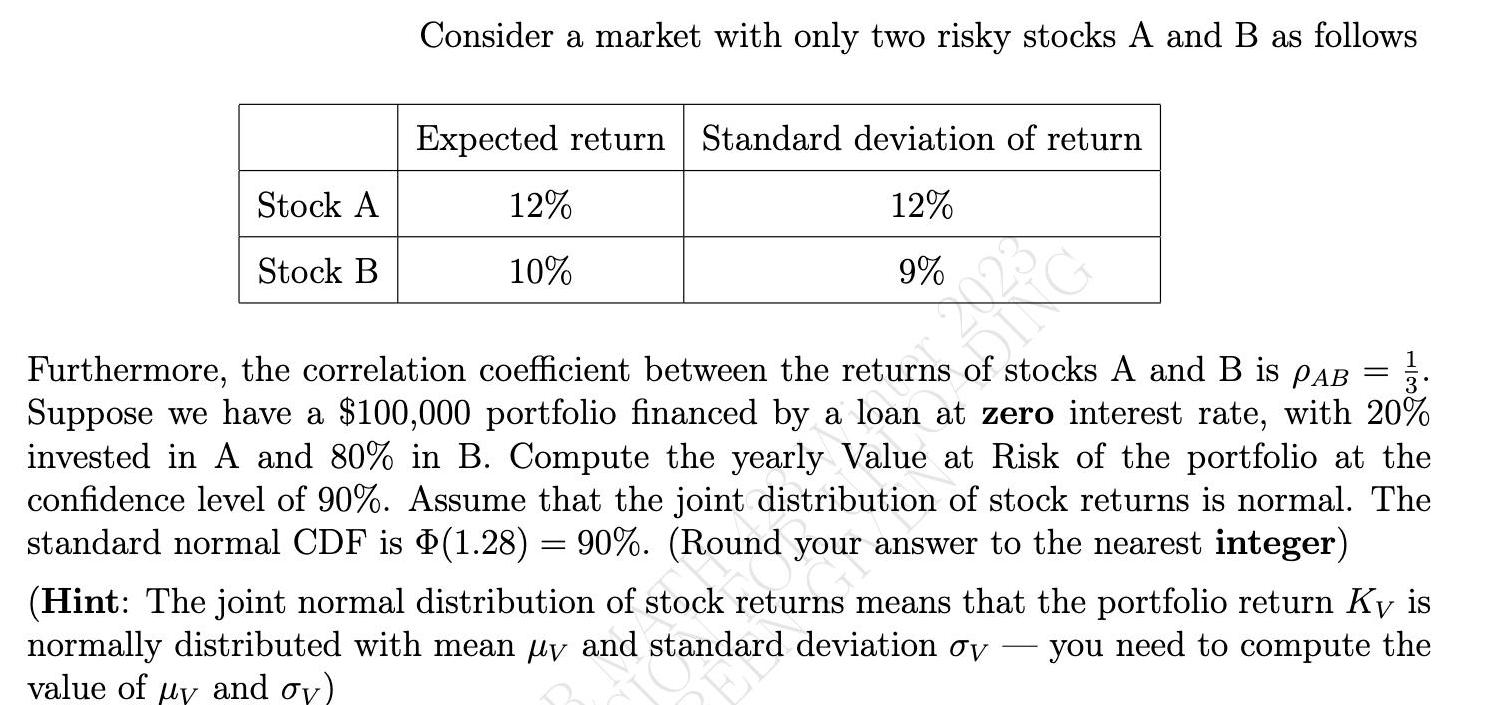

Question: Stock A Stock B Consider a market with only two risky stocks A and B as follows Expected return Standard deviation of return 12%

Stock A Stock B Consider a market with only two risky stocks A and B as follows Expected return Standard deviation of return 12% 9% 12% 10% 3. Furthermore, the correlation coefficient between the returns of stocks A and B is PAB Suppose we have a $100,000 portfolio financed by a loan at zero interest rate, with 20% invested in A and 80% in B. Compute the yearly Value at Risk of the portfolio at the confidence level of 90%. Assume that the joint distribution of stock returns is normal. The standard normal CDF is (1.28) = 90%. (Round your answer to the nearest integer) - (Hint: The joint normal distribution of stock returns means that the portfolio return Ky is normally distributed with mean y and standard deviation ov - you need to compute the - value of uy and oy)

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

a To estimate Jensens alpha for the stock we need to compare the actual return of the stock with the expected return based on the Capital Asset Pricing Model CAPM Jensens alpha is calculated as the ex... View full answer

Get step-by-step solutions from verified subject matter experts