Question: Problem 6 (12 points) Beck Construction Company began work on a new building project on January 1, 2016. The project is to be completed by

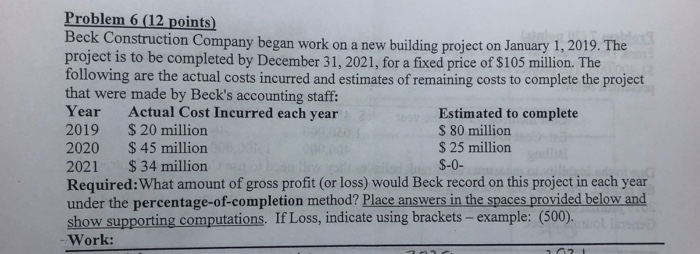

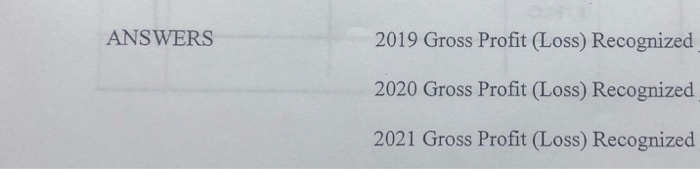

Problem 6 (12 points) Beck Construction Company began work on a new building project on January 1, 2016. The project is to be completed by December 31, 2021, for a fixed price of $105 million. The following are the actual costs incurred and estimates of remaining costs to complete the project that were made by Beck's accounting staff: Year Actual Cost Incurred each year Estimated to complete 2019 $ 20 million $ 80 million 2020 $ 45 million $ 25 million 2021 $ 34 million $-0- Required:What amount of gross profit (or loss) would Beck record on this project in each year under the percentage-of-completion method? Place answers in the spaces provided below and show supporting computations. If Loss, indicate using brackets - example: (500). -Work: ANSWERS 2019 Gross Profit (Loss) Recognized 2020 Gross Profit (Loss) Recognized 2021 Gross Profit (Loss) Recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts