Question: PROBLEM 6- 13 AND 14 Problem 6-13 (LAA) On January 1, 2020, Marsh Company issued 10% bonds on January 1, 2030. The bonds were issued

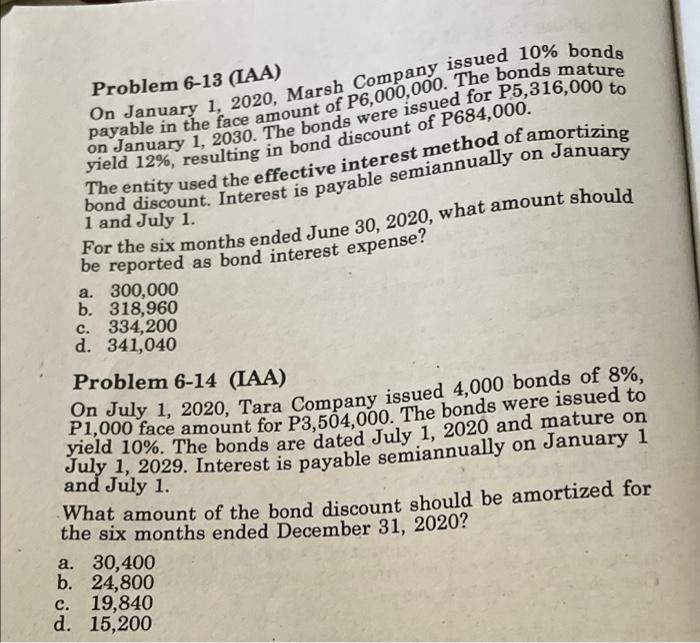

Problem 6-13 (LAA) On January 1, 2020, Marsh Company issued 10% bonds on January 1, 2030. The bonds were issued for P5,316,000 to payable in the face amount of P6,000,000. The bonds mature yield 12%, resulting in bond discount of P684,000. bond discount. Interest is payable semiannually on January The entity used the effective interest method of amortizing For the six months ended June 30, 2020, what amount should be reported as bond interest expense? 1 and July 1. a. 300,000 b. 318,960 c. 334,200 d. 341,040 Problem 6-14 (IAA) Pr July 1, 2020, Tara Company issued 4,000 bonds of 8%, yield 10%. The bonds are dated July 1, 2020 and mature on P:1,000 face amount for P3,504,000. The bonds were issued to July 1, 2029. Interest is payable semiannually on January 1 and July 1. What amount of the bond discount should be amortized for the six months ended December 31, 2020? a. 30,400 b. 24,800 c. 19,840 d. 15,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts