Question: Problem 6 - 2 2 Special Taxpayer Situations ( LO 6 . 8 ) Jervis Vision, a single taxpayer under age 6 5 , filed

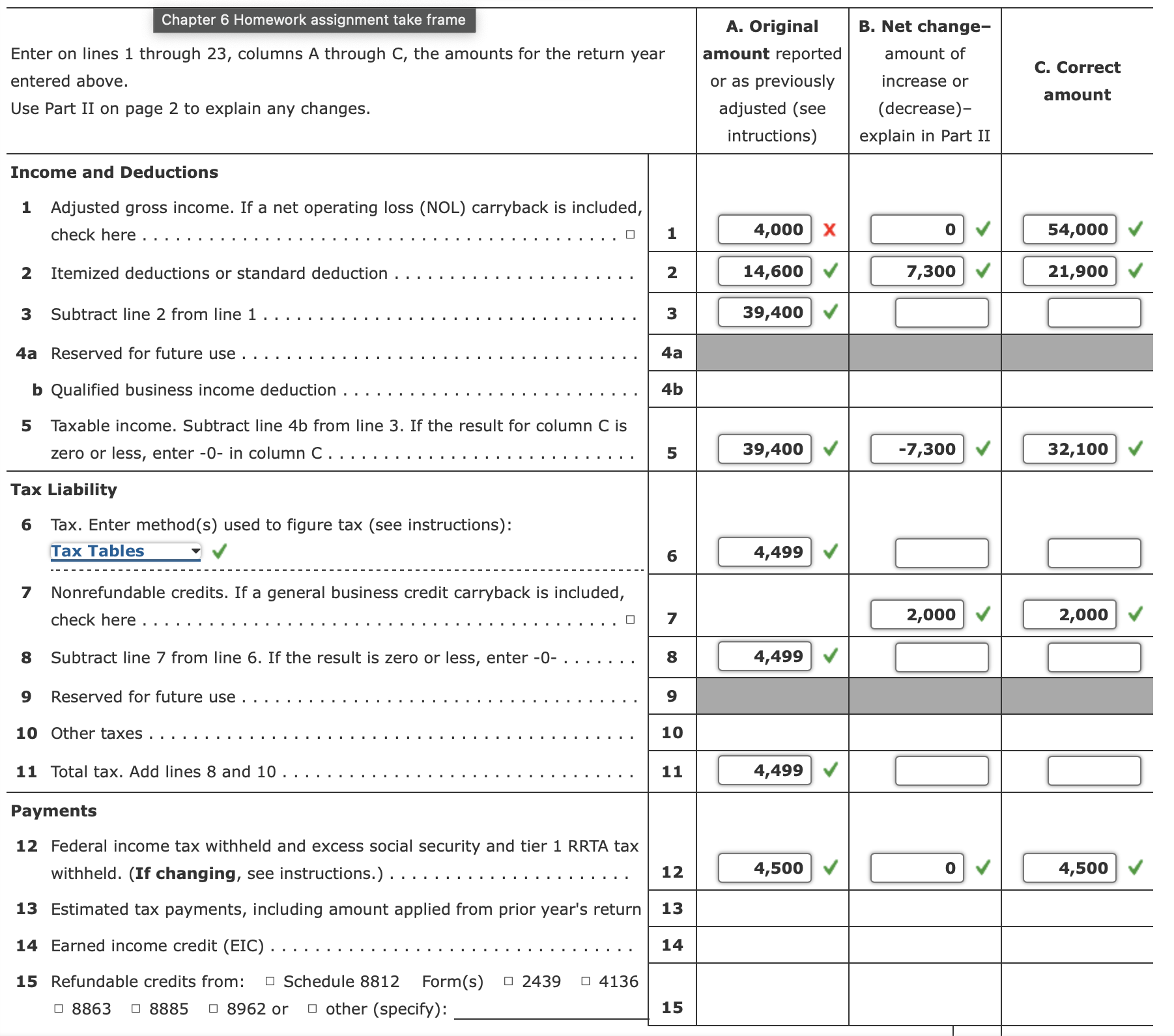

Problem Special Taxpayer Situations LO Jervis Vision, a single taxpayer under age filed his tax return in early He realized after the due date that he failed to rightfully claim his child Wanda Vision, age Social Security number as a dependent and change his status to head of household. His original Form reported AGI of $all wages and the standard deduction for a single taxpayer resulting in tax liability of $ He had $ income tax withheld from his pay during Prepare a Form X to report Jervis' change in filing status. Note that Jervis is now eligible for a child tax credit of $ Jervis' Social Security number is and he lives at End St Apt. F New York, NY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock