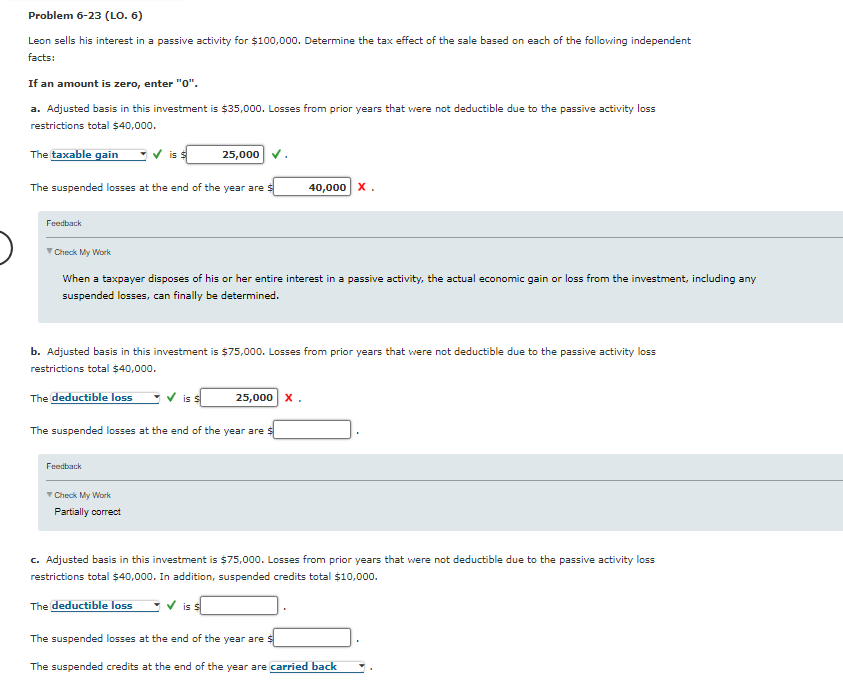

Question: Problem 6 - 2 3 ( LO . 6 ) Leon sells his interest in a passive activity for $ 1 0 0 , 0

Problem LO

Leon sells his interest in a passive activity for $ Determine the tax effect of the sale based on each of the following independent

facts:

If an amount is zero, enter

a Adjusted basis in this investment is $ Losses from prior years that were not deductible due to the passive activity loss

restrictions total $

The

is $

The suspended losses at the end of the year are $

When a taxpayer disposes of his or her entire interest in a passive activity, the actual economic gain or loss from the investment, including any

suspended losses, can finally be determined.

b Adjusted basis in this investment is $ Losses from prior years that were not deductible due to the passive activity loss

restrictions total $

The deductible loss is s

x

The suspended losses at the end of the year are $

Feedback

T Check My Work

Partially correct

c Adjusted basis in this investment is $ Losses from prior years that were not deductible due to the passive activity loss

restrictions total $ In addition, suspended credits total $

The

is

The suspended losses at the end of the year are $

The suspended credits at the end of the year are

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock