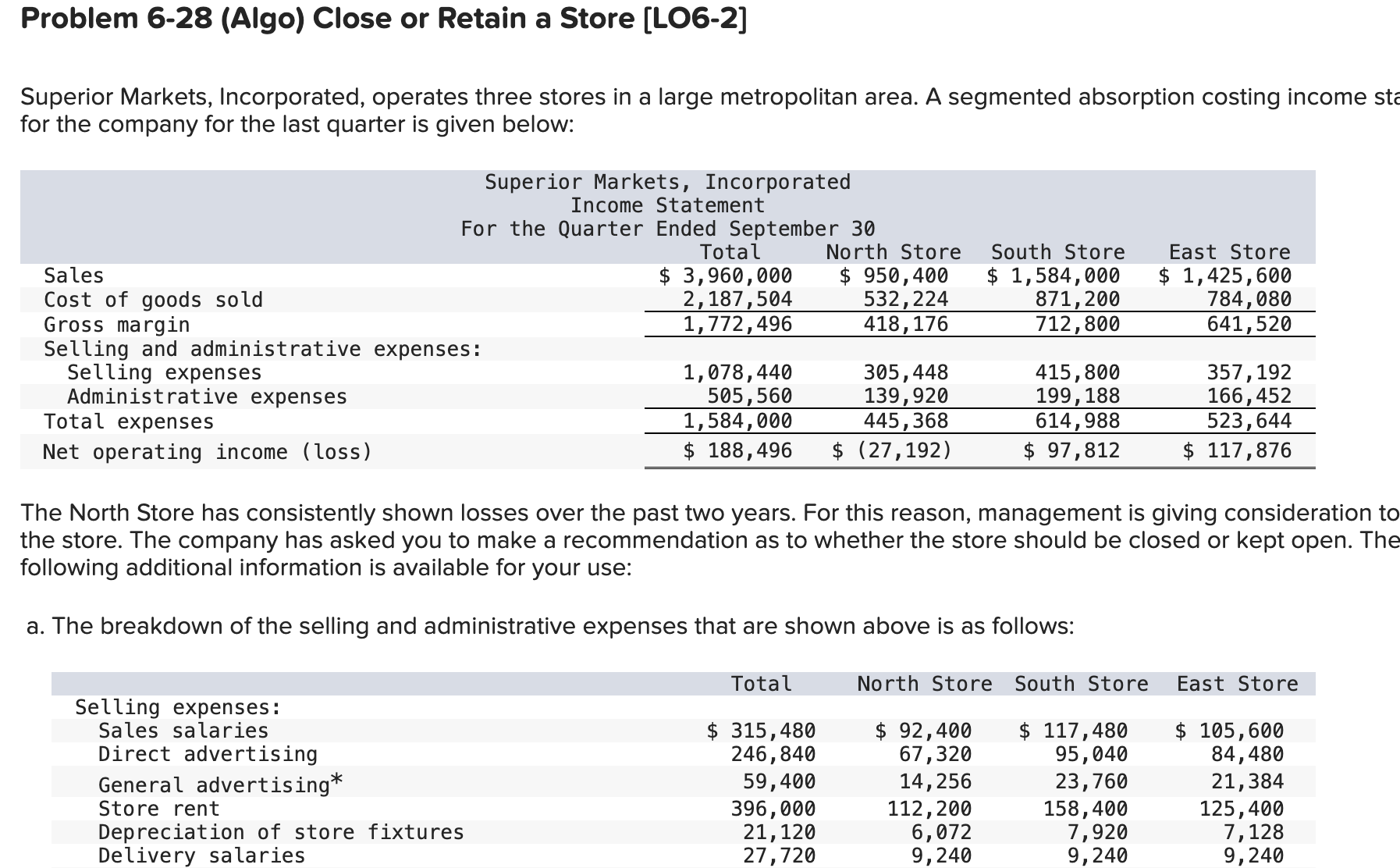

Question: Problem 6 - 2 8 ( Algo ) Close or Retain a Store [ LO 6 - 2 ] Superior Markets, Incorporated, operates three stores

Problem Algo Close or Retain a Store LO Superior Markets, Incorporated, operates three stores in a large metropolitan area. A segmented absorption costing income sta for the company for the last quarter is given below: begintabularlllllhline multicolumncSuperior Markets, Incorporated Income Statementhline Sales & $ & $ & $ & $ hline Cost of goods sold & & & & hline Gross margin & & & & hline multicolumnlSelling and administrative expenses:hline Selling expenses & & & & hline Administrative expenses & & & & hline Total expenses & & & & hline Net operating income loss & $ & $ & $ & $ hline endtabular The North Store has consistently shown losses over the past two years. For this reason, management is giving consideration to the store. The company has asked you to make a recommendation as to whether the store should be closed or kept open. The following additional information is available for your use: a The breakdown of the selling and administrative expenses that are shown above is as follows: begintabularlllllhline & Total & North Store & South Store & East Store hline multicolumnlSelling expenses:hline Sales salaries & $ & $ & $ & $ hline Direct advertising & & & & hline General advertising & & & & hline Store rent & & & & hline Depreciation of store fixtures & & & & hline Delivery salaries & & & & hline endtabular Required:

How much employee salaries will the company avoid if it closes the North Store?

How much employment taxes will the company avoid if it closes the North Store?

What is the financial advantage disadvantage of closing the North Store?

Assuming that the North Store's floor space can't be subleased, would you recommend closing the North Store?

Assume that the North Store's floor space can't be subleased. However, let's introduce three more assumptions. First, assume that if the North Store were closed, onefourth of its sales would transfer to the East Store, due to strong customer loyalty to Superior Markets. Second, assume that the East Store has enough capacity to handle the increased sales that would arise from closing the North Store. Third, assume that the increased sales in the East Store would yield the same gross margin as a percentage of sales as present sales in the East store. Given these new assumptions, what is the financial advantage disadvantage of closing the North Store?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock