Question: Problem 6 - 4 3 ( LO . 3 ) Terry traveled to a neighboring state to investigate the purchase of two hardware stores. His

Problem LO

Terry traveled to a neighboring state to investigate the purchase of two hardware stores. His expenses included travel, legal, accounting,

and miscellaneous expenses. The total was $ He incurred the expenses in June and July Under the following circumstances,

what can Terry deduct in

In your computations, round the per month amount to two decimal places and use rounded amount in subsequent

computations. If required, round your final answers to the nearest dollar. If an amount is zero, O

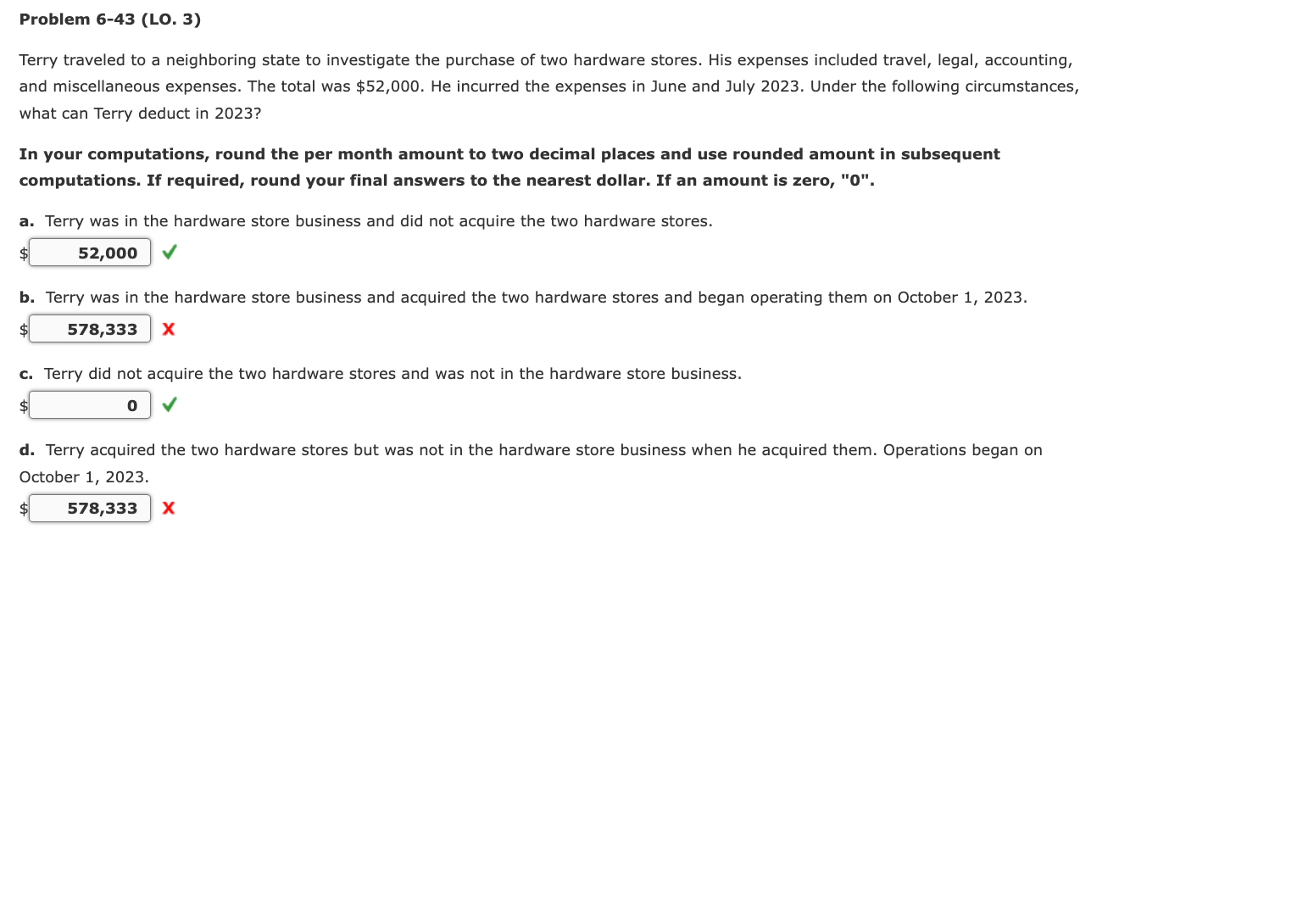

a Terry was in the hardware store business and did not acquire the two hardware stores.

$

b Terry was in the hardware store business and acquired the two hardware stores and began operating them on October

$

c Terry did not acquire the two hardware stores and was not in the hardware store business.

$

d Terry acquired the two hardware stores but was not in the hardware store business when he acquired them. Operations began on

October

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock