Question: Problem 6 - 4 5 ( LO . 3 ) Alex, who is single, conducts an activity in the current year that is appropriately classified

Problem LO

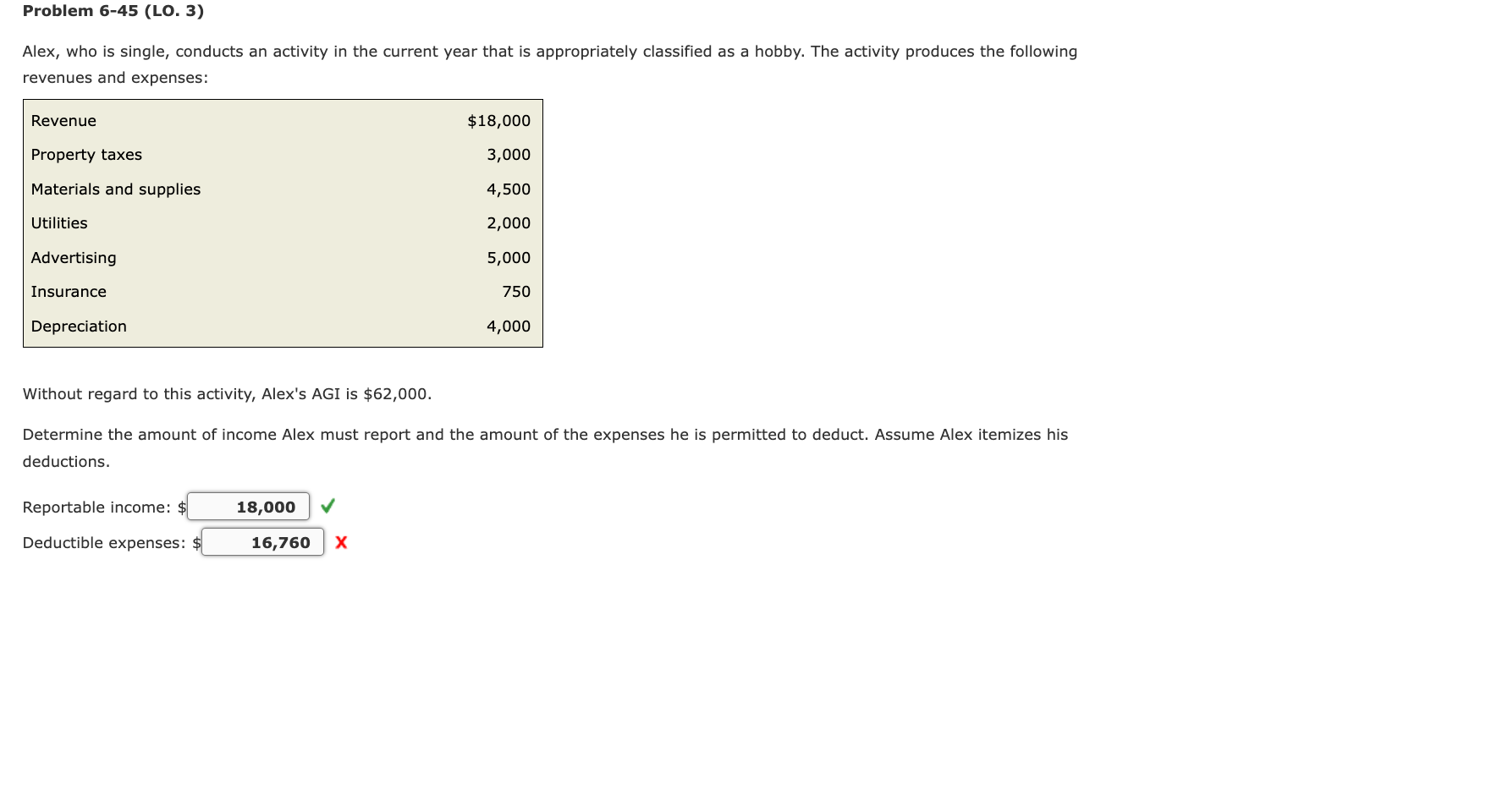

Alex, who is single, conducts an activity in the current year that is appropriately classified as a hobby. The activity produces the following

revenues and expenses:

Without regard to this activity, Alex's AGI is $

Determine the amount of income Alex must report and the amount of the expenses he is permitted to deduct. Assume Alex itemizes his

deductions.

Reportable income: $

Deductible expenses: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock