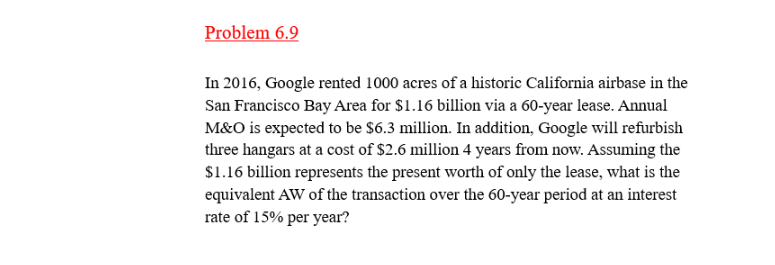

Question: Problem 6 . 9 In 2 0 1 6 , Google rented 1 0 0 0 acres of a historic California airbase in the San

Problem In Google rented acres of a historic California airbase in the San Francisco Bay Area for $ billion via a year lease. Annual M&O is expected to be $ million. In addition, Google will refurbish three hangars at a cost of $ million years from now. Assuming the $ billion represents the present worth of only the lease, what is the equivalent AW of the transaction over the year period at an interest rate of per year?

draw the cash flow diagram to used in my report

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock