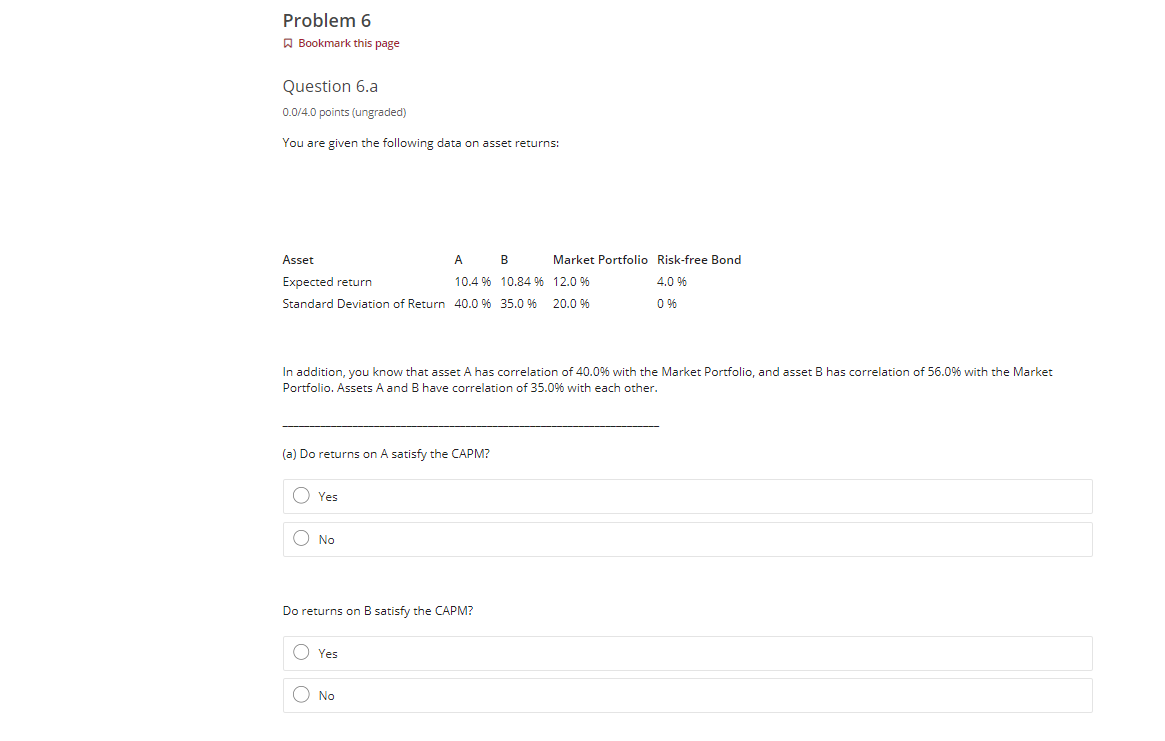

Question: Problem 6 A Bookmark this page Question 6.a 0.0/4.0 points (ungraded) You are given the following data on asset returns: Asset Market Portfolio Risk-free Bond

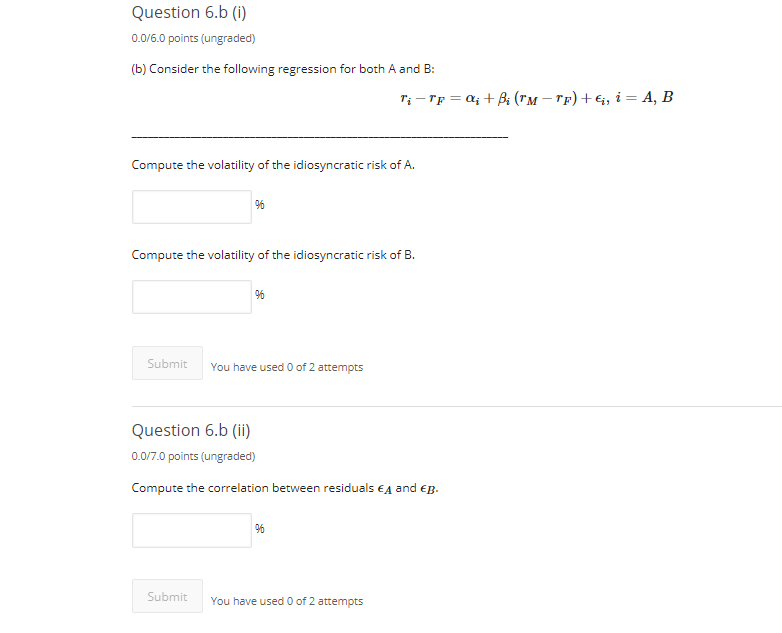

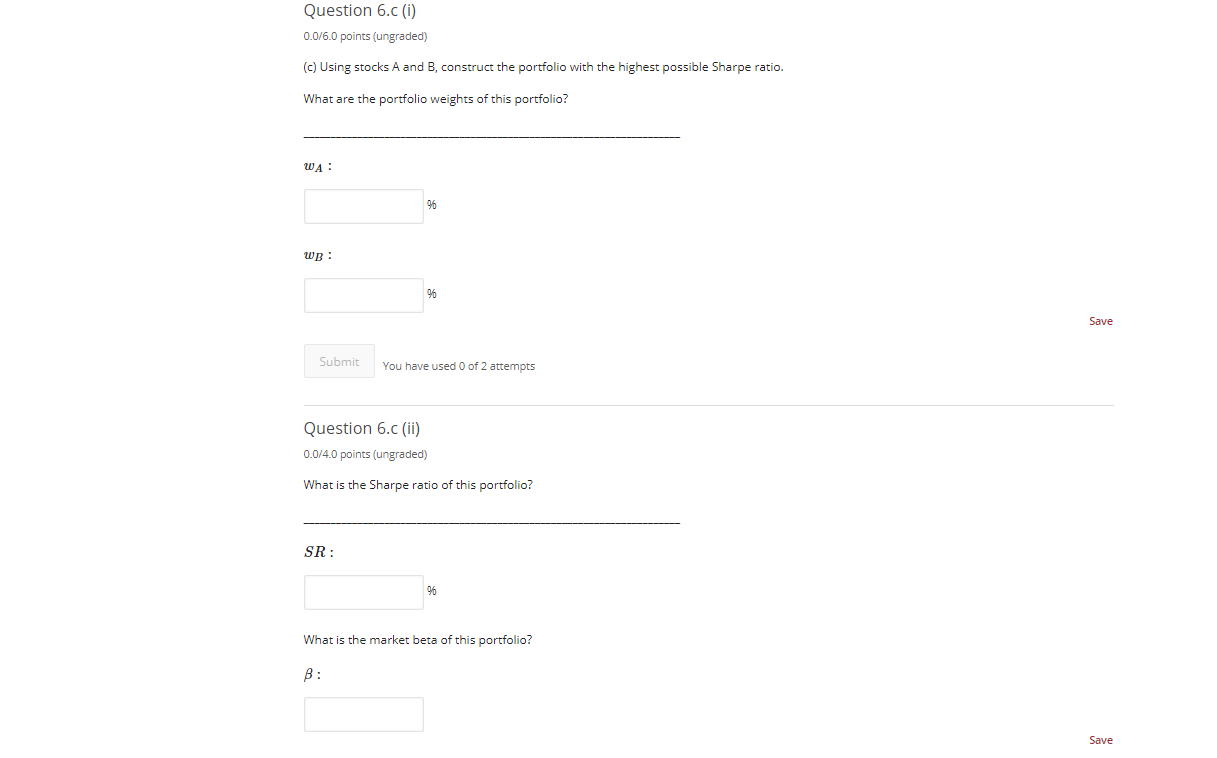

Problem 6 A Bookmark this page Question 6.a 0.0/4.0 points (ungraded) You are given the following data on asset returns: Asset Market Portfolio Risk-free Bond Expected return 10.4 % 10.84 96 12.096 4.096 Standard Deviation of Return 40.0 % 35.0 % 20.0 % 096 In addition, you know that asset A has correlation of 40.09 with the Market Portfolio, and asset B has correlation of 56.0% with the Market Portfolio. Assets A and B have correlation of 35.0% with each other. (a) Do returns on A satisfy the CAPM? O Yes O No Do returns on B satisfy the CAPM? O Yes O Question 6.b (1) 0.0/6.0 points (ungraded) (b) Consider the following regression for both A and B: Ti-re=ai + Bi (TM-TP) +, i = A, B Compute the volatility of the idiosyncratic risk of A. 96 Compute the volatility of the idiosyncratic risk of B. 96 Submit You have used 0 of 2 attempts Question 6.b (ii) 0.0/7.0 points (ungraded) Compute the correlation between residuals EA and EB. 96 Submit You have used 0 of 2 attempts Question 6.c (i) 0.0/6.0 points (ungraded) (c) Using stocks A and B, construct the portfolio with the highest possible Sharpe ratio. What are the portfolio weights of this portfolio? WA: 96 wp : 96 Save Submit You have used 0 of 2 attempts Question 6.c (ii) 0.0/4.0 points (ungraded) What is the Sharpe ratio of this portfolio? SR: What is the market beta of this portfolio? B: Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts