Question: Problem #6: Calculating Net Capital Spending, Change in Net Working Capital, and various cash flows. (Worth 2 pts) Ohmy Media Balance sheet and income statement

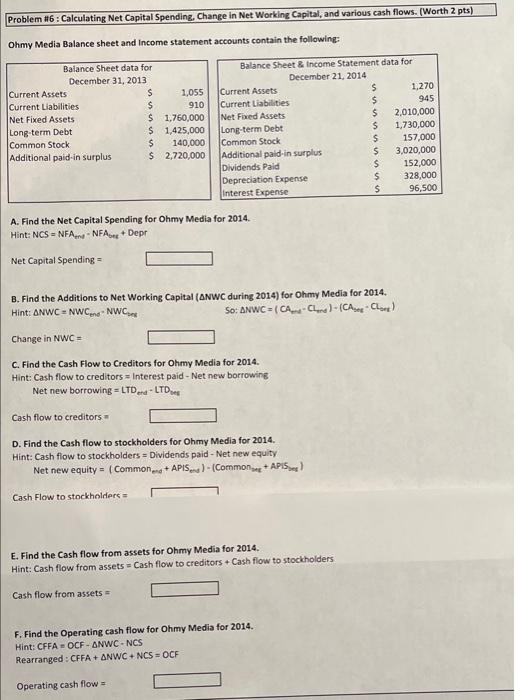

Problem #6: Calculating Net Capital Spending, Change in Net Working Capital, and various cash flows. (Worth 2 pts) Ohmy Media Balance sheet and income statement accounts contain the following: Balance Sheet data for December 31, 2013 Current Assets $ 1,055 Current Liabilities $ 910 Net Fixed Assets $ 1,760,000 Long-term Debt $ 1,425,000 Common Stock $ 140,000 Additional paid-in surplus $ 2,720,000 Balance Sheet Income Statement data for December 21, 2014 Current Assets $ 1,270 Current Liabilities $ 945 Net Fixed Assets $ 2,010,000 Long-term Debt $ 1,730,000 Common Stock S 157,000 Additional paid-in surplus $ 3,020,000 Dividends Paid $ 152,000 Depreciation Expense $ 328,000 Interest Expense $ 96,500 A. Find the Net Capital Spending for Ohmy Media for 2014 Hint: NCS = NFA... NFA Depr Net Capital Spending - B. Find the Additions to Net Working Capital (ANWC during 2014) for Ohmy Media for 2014. Hint: ANWCNWCene NWC So: ANWC = (-1)+ (CAO) Change in NWC- C. Find the Cash Flow to Creditors for Ohmy Media for 2014. Hint: Cash flow to creditors - Interest paid - Net new borrowing Net new borrowing = LTD - LTD Cash flow to creditors - D. Find the Cash flow to stockholders for Ohmy Media for 2014. Hint: Cash flow to stockholders = Dividends paid - Net new equity Net new equity = (Common end + APIS.)- (Common +APIS) Cash Flow to stockholders E. Find the Cash flow from assets for Ohmy Media for 2014. Hint: Cash flow from assets Cash flow to creditors + Cash flow to stockholders Cash flow from assets F. Find the Operating cash flow for Ohmy Media for 2014. Hint: CFFA = OCF - ANWC-NCS Rearranged: CFFA + ANWC + NCS = OCF Operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts