Question: Problem 6. Consider a Black-Scholes market, where we have written a European put option on a stock with a 1-year expiration date. The underlying

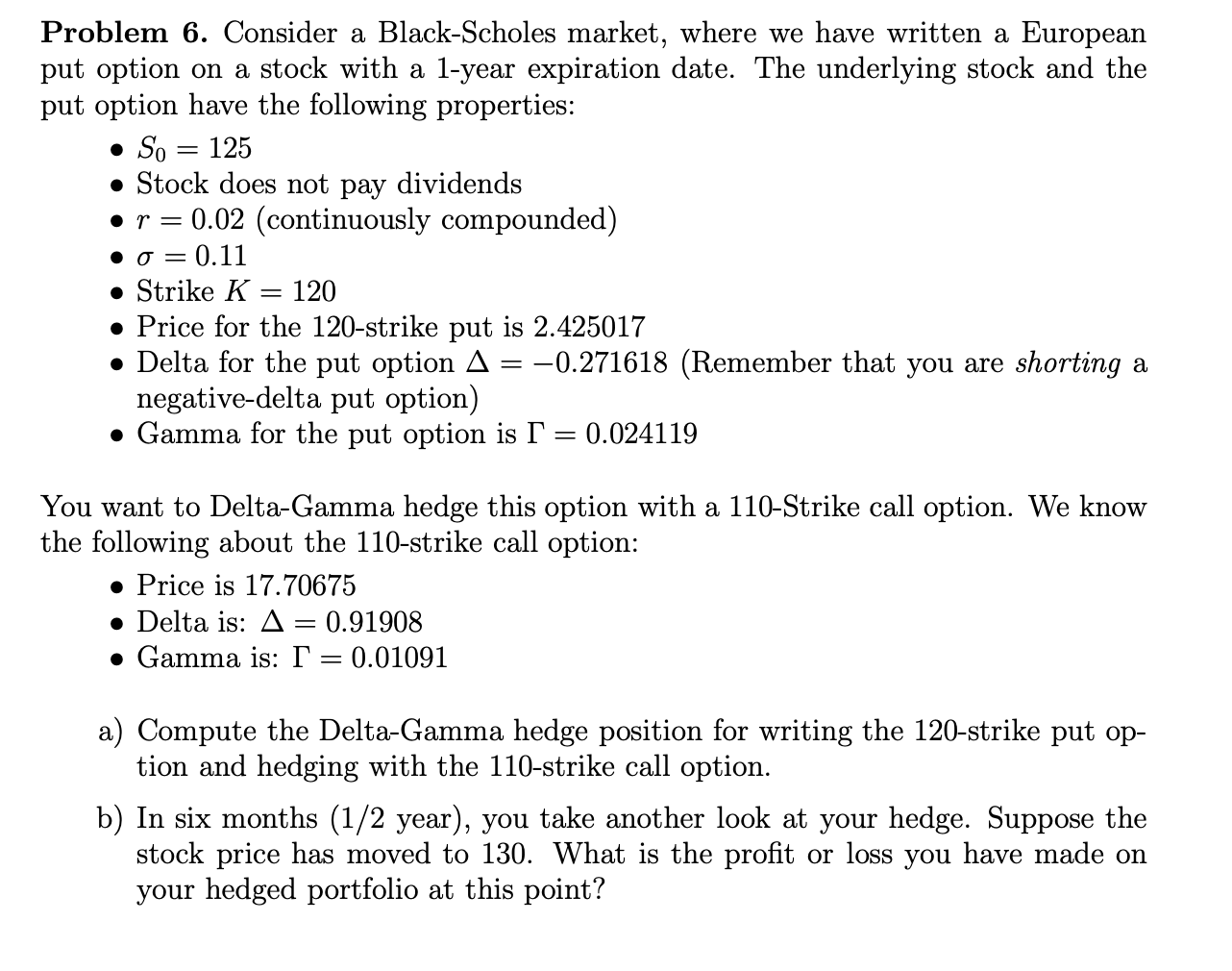

Problem 6. Consider a Black-Scholes market, where we have written a European put option on a stock with a 1-year expiration date. The underlying stock and the put option have the following properties: So = 125 Stock does not pay dividends r = = 0.02 (continuously compounded) = = 0.11 Strike K = 120 Price for the 120-strike put is 2.425017 Delta for the put option A negative-delta put option) = -0.271618 (Remember that you are shorting a = 0.024119 Gamma for the put option is You want to Delta-Gamma hedge this option with a 110-Strike call option. We know the following about the 110-strike call option: Price is 17.70675 Delta is: A = 0.91908 Gamma is: F = 0.01091 a) Compute the Delta-Gamma hedge position for writing the 120-strike put op- tion and hedging with the 110-strike call option. b) In six months (1/2 year), you take another look at your hedge. Suppose the stock price has moved to 130. What is the profit or loss you have made on your hedged portfolio at this point?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts