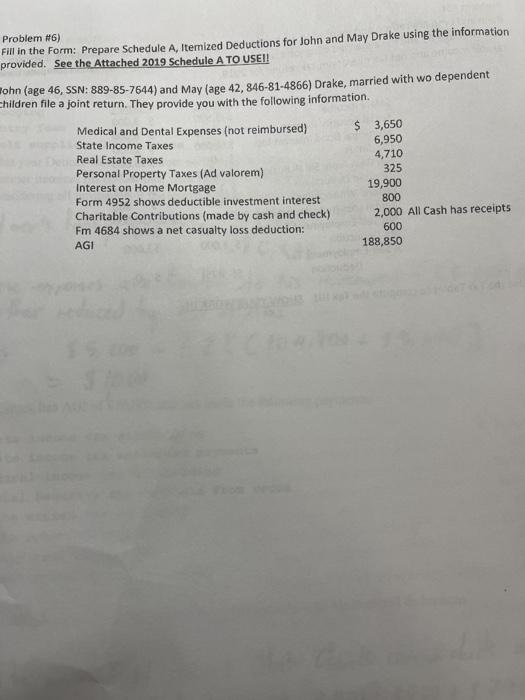

Question: Problem #6) Fill in the Form: Prepare Schedule A, Iterized Deductions for John and May Drake using the information provided. See the Attached 2019 Schedule

Problem #6) Fill in the Form: Prepare Schedule A, Iterized Deductions for John and May Drake using the information provided. See the Attached 2019 Schedule A TO USEI! ohn (age 46, SSN: 889-85-7644) and May (age 42,846-81-4866) Drake, married with wo dependent Children file a joint return. They provide you with the following information. Medical and Dental Expenses (not reimbursed) $ 3,650 State Income Taxes 6,950 Real Estate Taxes 4,710 Personal Property Taxes (Ad valorem) 325 Interest on Home Mortgage 19,900 Form 4952 shows deductible investment interest 800 Charitable Contributions (made by cash and check) 2,000 All Cash has receipts Fm 4684 shows a net casualty loss deduction: 600 AGI 188,850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts