Question: Problem 6 Intro The exchange rate between euros and dollars is currently $1.17 per euro. Annual inflation is expected to be 1.8% in Europe and

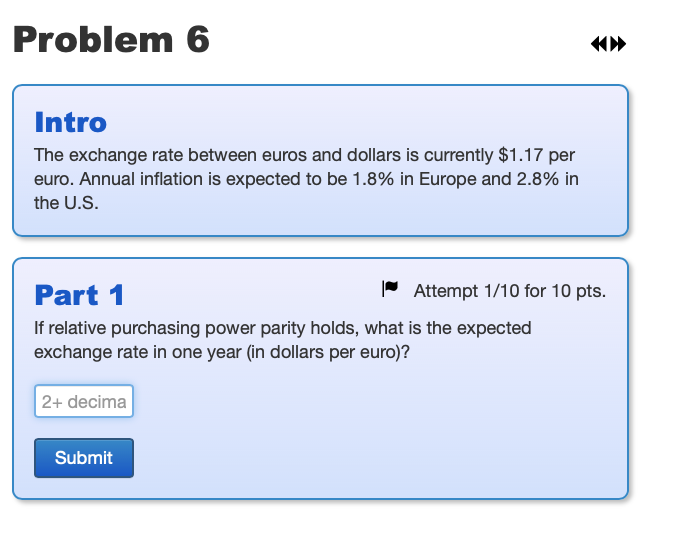

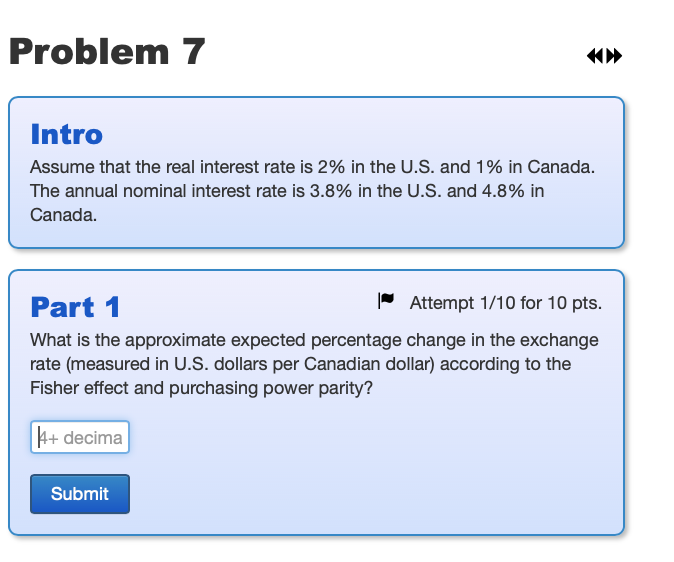

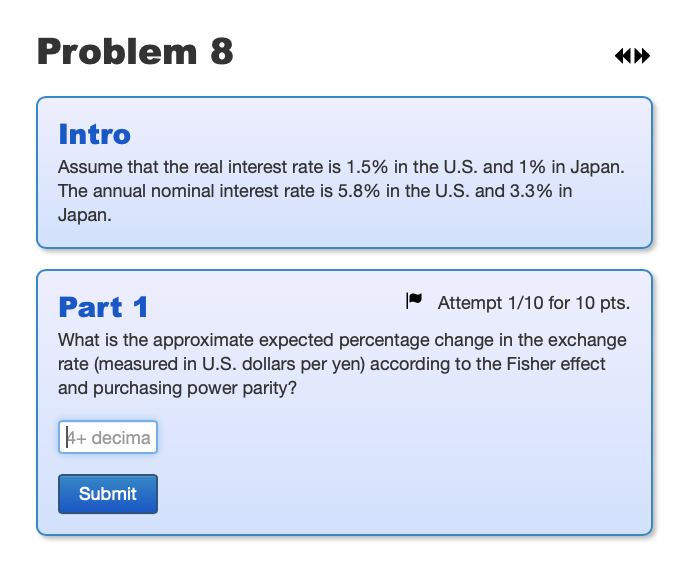

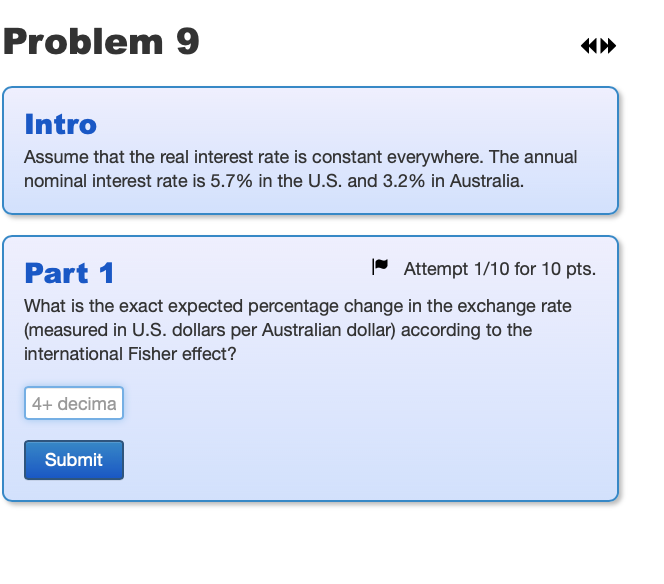

Problem 6 Intro The exchange rate between euros and dollars is currently $1.17 per euro. Annual inflation is expected to be 1.8% in Europe and 2.8% in the U.S. Part 1 Attempt 1/10 for 10 pts. If relative purchasing power parity holds, what is the expected exchange rate in one year (in dollars per euro)? 2+ decima Submit Problem 7 Intro Assume that the real interest rate is 2% in the U.S. and 1% in Canada. The annual nominal interest rate is 3.8% in the U.S. and 4.8% in Canada. Part 1 Attempt 1/10 for 10 pts. What is the approximate expected percentage change in the exchange rate (measured in U.S. dollars per Canadian dollar) according to the Fisher effect and purchasing power parity? A+ decima Submit Problem 8 Intro Assume that the real interest rate is 1.5% in the U.S. and 1% in Japan. The annual nominal interest rate is 5.8% in the U.S. and 3.3% in Japan. Part 1 Attempt 1/10 for 10 pts. What is the approximate expected percentage change in the exchange rate (measured in U.S. dollars per yen) according to the Fisher effect and purchasing power parity? H+ decima Submit Problem 9 Intro Assume that the real interest rate is constant everywhere. The annual nominal interest rate is 5.7% in the U.S. and 3.2% in Australia. Part 1 Attempt 1/10 for 10 pts. What is the exact expected percentage change in the exchange rate (measured in U.S. dollars per Australian dollar) according to the international Fisher effect? 4+ decima Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts