Question: problem 6 pls 5. Firm Magic has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that

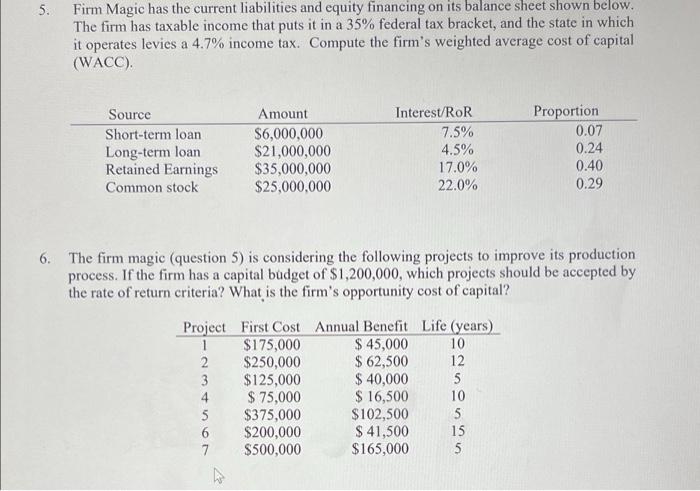

5. Firm Magic has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that puts it in a 35% federal tax bracket, and the state in which it operates levies a 4.7% income tax. Compute the firm's weighted average cost of capital (WACC). Source Short-term loan Long-term loan Retained Earnings Common stock Amount $6,000,000 $21,000,000 $35,000,000 $25,000,000 Interest/ROR 7.5% 4.5% 17.0% 22.0% Proportion 0.07 0.24 0.40 0.29 6. The firm magic (question 5) is considering the following projects to improve its production process. If the firm has a capital budget of $1,200,000, which projects should be accepted by the rate of return criteria? What is the firm's opportunity cost of capital? Project First Cost Annual Benefit Life (years) 1 $175,000 $ 45,000 10 2 $250,000 $62,500 12 3 $125,000 $ 40,000 5 4 $ 75,000 $ 16,500 10 5 $375,000 $102,500 6 $200,000 $ 41,500 15 7 $500,000 $165,000 5 uuuugo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts