Question: Problem 6: Present Value / Valuing Long Term Liabilities (30 Points) Manchester Corporation takes a 20-year mortgage of $15 million. The annual interest rate

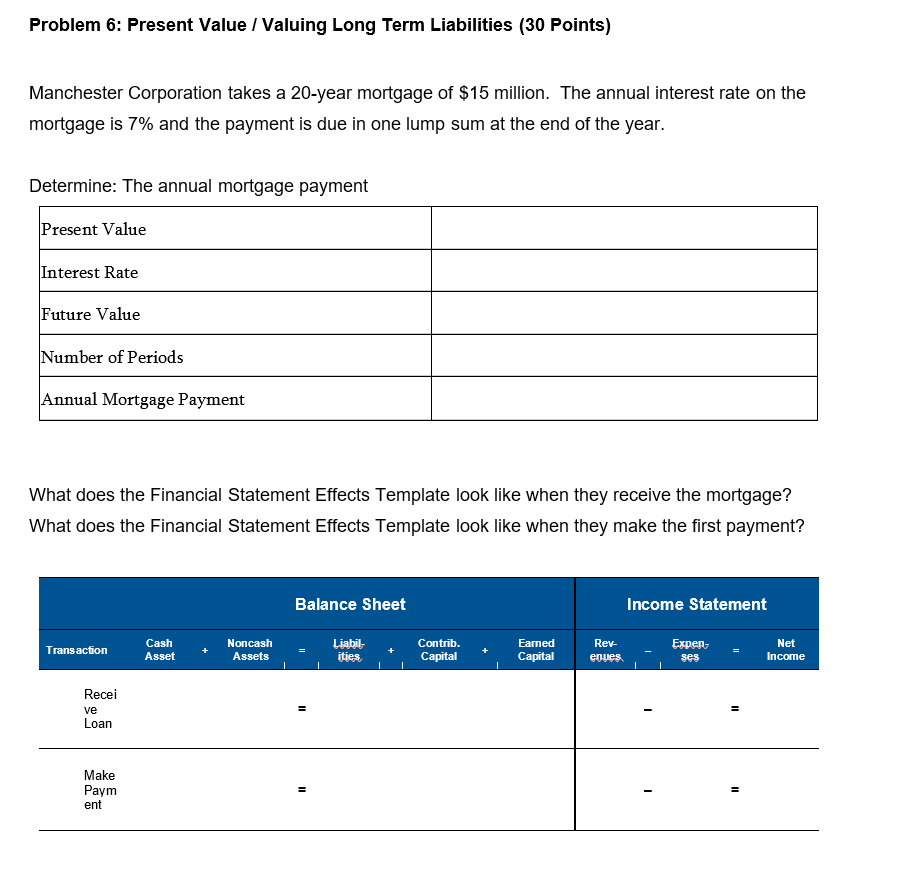

Problem 6: Present Value / Valuing Long Term Liabilities (30 Points) Manchester Corporation takes a 20-year mortgage of $15 million. The annual interest rate on the mortgage is 7% and the payment is due in one lump sum at the end of the year. Determine: The annual mortgage payment Present Value Interest Rate Future Value Number of Periods Annual Mortgage Payment What does the Financial Statement Effects Template look like when they receive the mortgage? What does the Financial Statement Effects Template look like when they make the first payment? Balance Sheet Income Statement Transaction Cash Asset Noncash Assets Liabil ities Contrib. Capital Earned Capital Rev- enues Expen- ses Net Income Recei ve Loan Make Paym ent = = - =

Step by Step Solution

There are 3 Steps involved in it

Receiving the Mortgage Transaction Receive ... View full answer

Get step-by-step solutions from verified subject matter experts