Question: Problem 6 The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. What is the

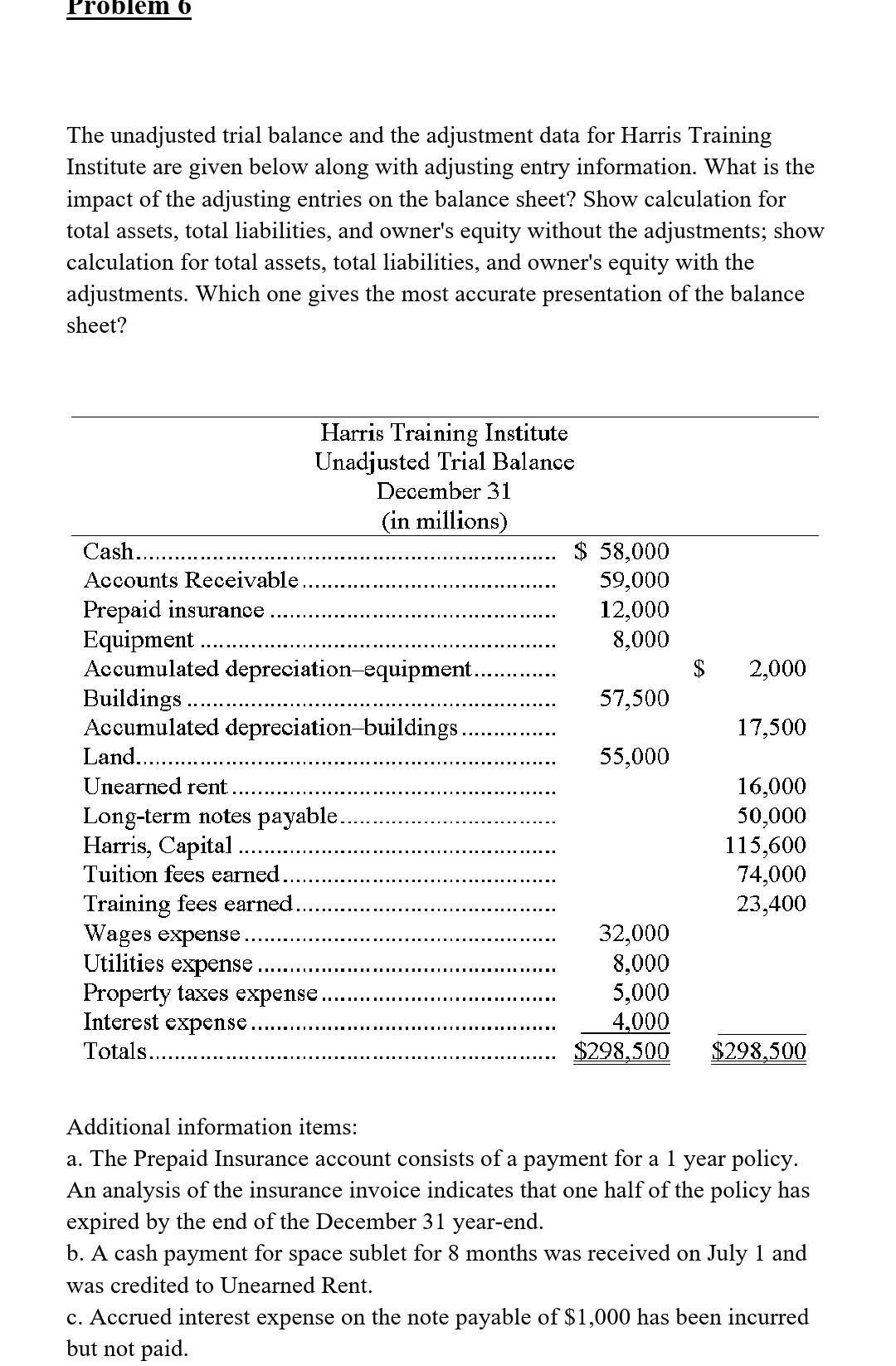

Problem 6 The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. What is the impact of the adjusting entries on the balance sheet? Show calculation for total assets, total liabilities, and owner's equity without the adjustments; show calculation for total assets, total liabilities, and owner's equity with the adjustments. Which one gives the most accurate presentation of the balance sheet? $ 2,000 17,500 Harris Training Institute Unadjusted Trial Balance December 31 (in millions) Cash. $ 58,000 Accounts Receivable 59,000 Prepaid insurance 12,000 Equipment. 8,000 Accumulated depreciation-equipment. Buildings .... 57,500 Accumulated depreciation-buildings. Land. 55,000 Unearned rent... Long-term notes payable. Harris, Capital Tuition fees earned. Training fees earned. Wages expense.. 32,000 Utilities expense 8,000 Property taxes expense 5,000 Interest expense 4,000 Totals.. $298,500 16,000 50,000 115,600 74,000 23,400 $298,500 Additional information items: a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end. b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent. c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts