Question: Problem 6-1 Calculating Project NPV Paul Restaurant is considering the purchase of a $10,600 souffl maker. The souffl maker has an economic life of 7

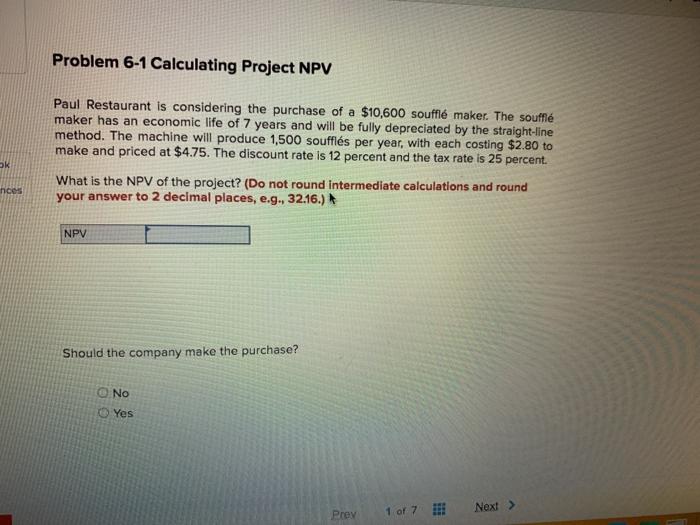

Problem 6-1 Calculating Project NPV Paul Restaurant is considering the purchase of a $10,600 souffl maker. The souffl maker has an economic life of 7 years and will be fully depreciated by the straight-line method. The machine will produce 1,500 souffls per year, with each costing $2.80 to make and priced at $475. The discount rate is 12 percent and the tax rate is 25 percent OK hices What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Should the company make the purchase? No Yes Prey 1 of 7 !!! Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts