Question: Problem 6-1 Presented below are September production and cost data for the second process center in the production of sealed-beam spotlights. September data for the

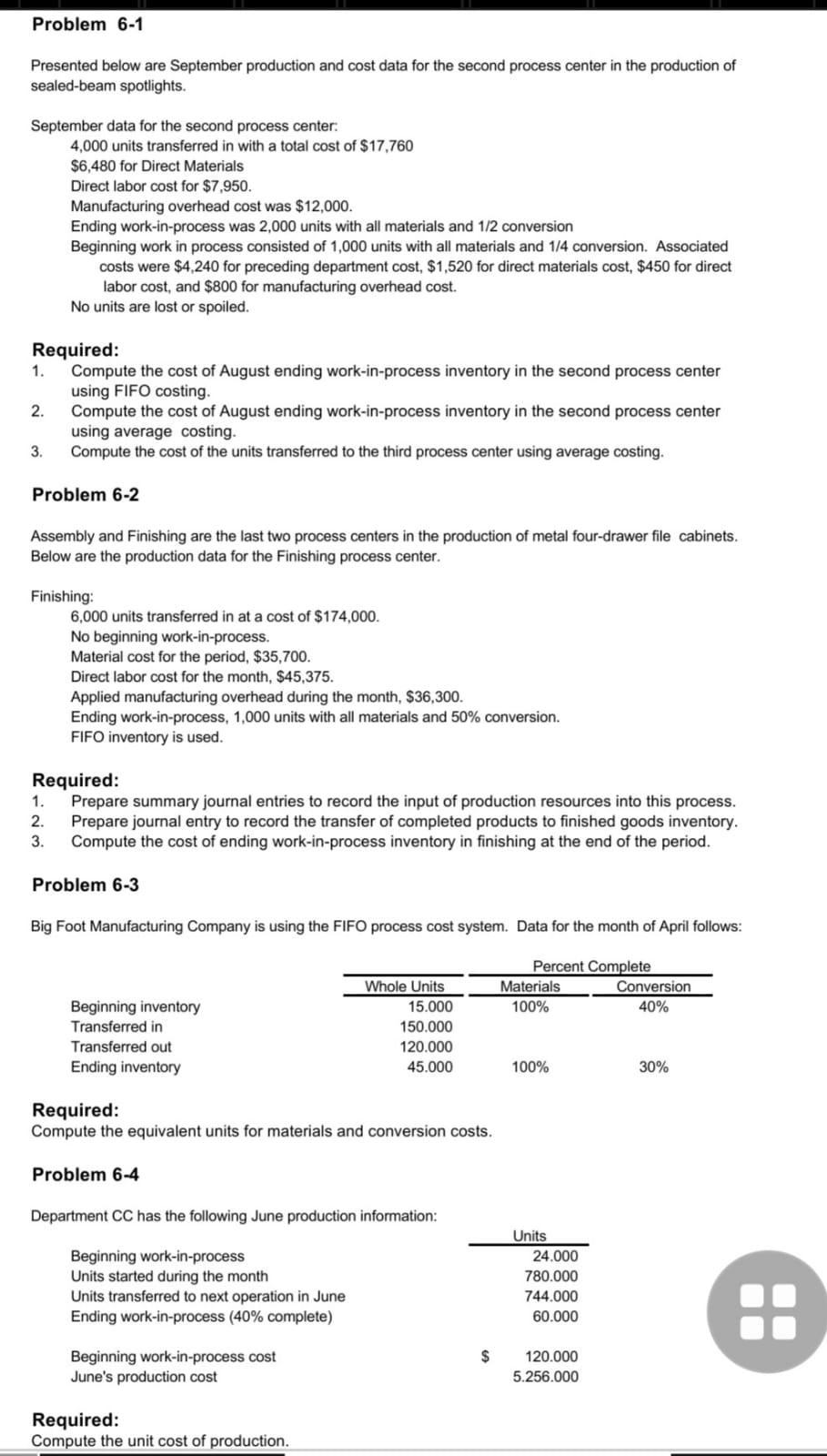

Problem 6-1 Presented below are September production and cost data for the second process center in the production of sealed-beam spotlights. September data for the second process center: 4,000 units transferred in with a total cost of $17.760 $6,480 for Direct Materials Direct labor cost for $7,950. Manufacturing overhead cost was $12,000. Ending work-in-process was 2,000 units with all materials and 1/2 conversion Beginning work in process consisted of 1,000 units with all materials and 1/4 conversion. Associated costs were $4,240 for preceding department cost, $1,520 for direct materials cost, $450 for direct labor cost, and $800 for manufacturing overhead cost. No units are lost or spoiled. Required: 1. Compute the cost of August ending work-in-process inventory in the second process center using FIFO costing. 2. Compute the cost of August ending work-in-process inventory in the second process center using average costing. 3. Compute the cost of the units transferred to the third process center using average costing. Problem 6-2 Assembly and Finishing are the last two process centers in the production of metal four-drawer file cabinets. Below are the production data for the Finishing process center. Finishing: 6,000 units transferred in at a cost of $174,000. No beginning work-in-process. Material cost for the period, $35,700. Direct labor cost for the month, $45,375. Applied manufacturing overhead during the month, $36,300. Ending work-in-process, 1,000 units with all materials and 50% conversion. FIFO inventory is used. Required: 1. Prepare summary journal entries to record the input of production resources into this process. 2. Prepare journal entry to record the transfer of completed products to finished goods inventory. w Compute the cost of ending work-in-process inventory in finishing at the end of the period. Problem 6-3 Big Foot Manufacturing Company is using the FIFO process cost system. Data for the month of April follows: Percent Complete Whole Units Materials Conversion Beginning inventory 15.000 100% 40% Transferred in 150.000 Transferred out 120.000 Ending inventory 45.000 100% 30% Required: Compute the equivalent units for materials and conversion costs. Problem 6-4 Department CC has the following June production information: Units Beginning work-in-process 24.000 Units started during the month 780.000 Units transferred to next operation in June 744.000 Ending work-in-process (40% complete) 60.000 Beginning work-in-process cost $ 120.000 June's production cost 5.256.000 Required: Compute the unit cost of production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts