Question: Problem 6-11 Cost Behaviour, Analysis of Mixed Costs, Contribution Margin Income Statement (LO1 - CC1, 3, 6; LO2 - CC7, 9; LO3 - CC12) The

Problem 6-11 Cost Behaviour, Analysis of Mixed Costs, Contribution Margin Income Statement (LO1 - CC1, 3, 6; LO2 - CC7, 9; LO3 - CC12)

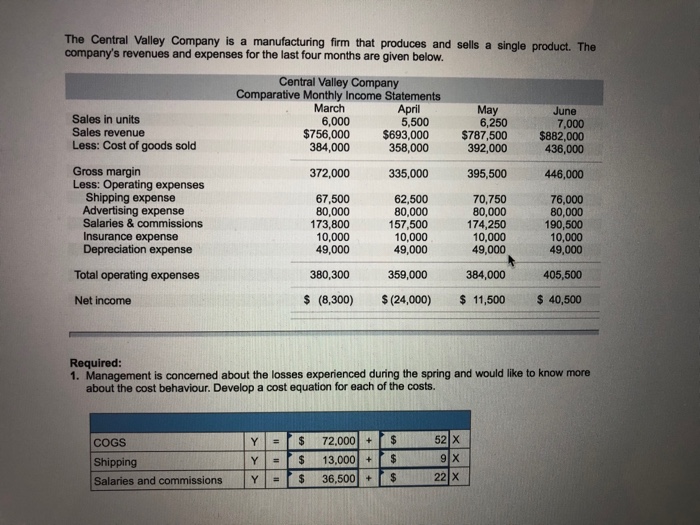

The Central Valley Company is a manufacturing firm that produces and sells a single product. The companys revenues and expenses for the last four months are given below.

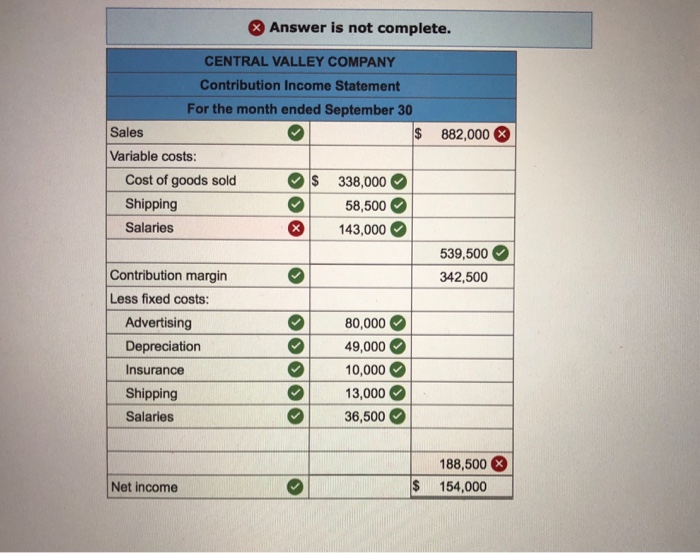

Please help me fix the income statement. And please please note that the income statement is for September not June, which means you cannot use 882000 as a sales revenue (thats why I got it wrong). Also, I got Sales(the category) wrong because that blank doesnt have sales and commissions as an option.

I am offering all the information I have though I also feel like there's something missing.

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Central Valley Company Comparative Monthly Income Statements March 6,000 May April 5,500 June Sales in units Sales revenue Less: Cost of goods sold 6,250 392,000 395,500 7,000 $756,000 $693,000 $787,500 $882,000 384,000 358,000 436,000 Gross margin Less: Operating expenses 372000 335,000 446,000 Shipping expense Advertising expense Salaries & commissions Insurance expense Depreciation expense 67,500 80,000 173,800 10,000 49,000 62,500 80,000 157,500 10,000 49,000 70,750 80,000 174,250 10,000 49,000 76,000 80,000 190,500 10,000 49,000 Total operating expenses 380,300 359,000 384,000 405,500 Net income $ (8,300) (24,000) 11,500 40,500 Required 1. Management is concerned about the losses experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. Y $ YI: $ 72,000| +r $ 13,000| +$ 36.500S 22 x COGS Shipping Salares and commissions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts