Question: Problem 6.12 Casper Landsten -- CIA (A) Casper Landsten is a foreign exchange trader for a bank in New York. He has $1 million (or

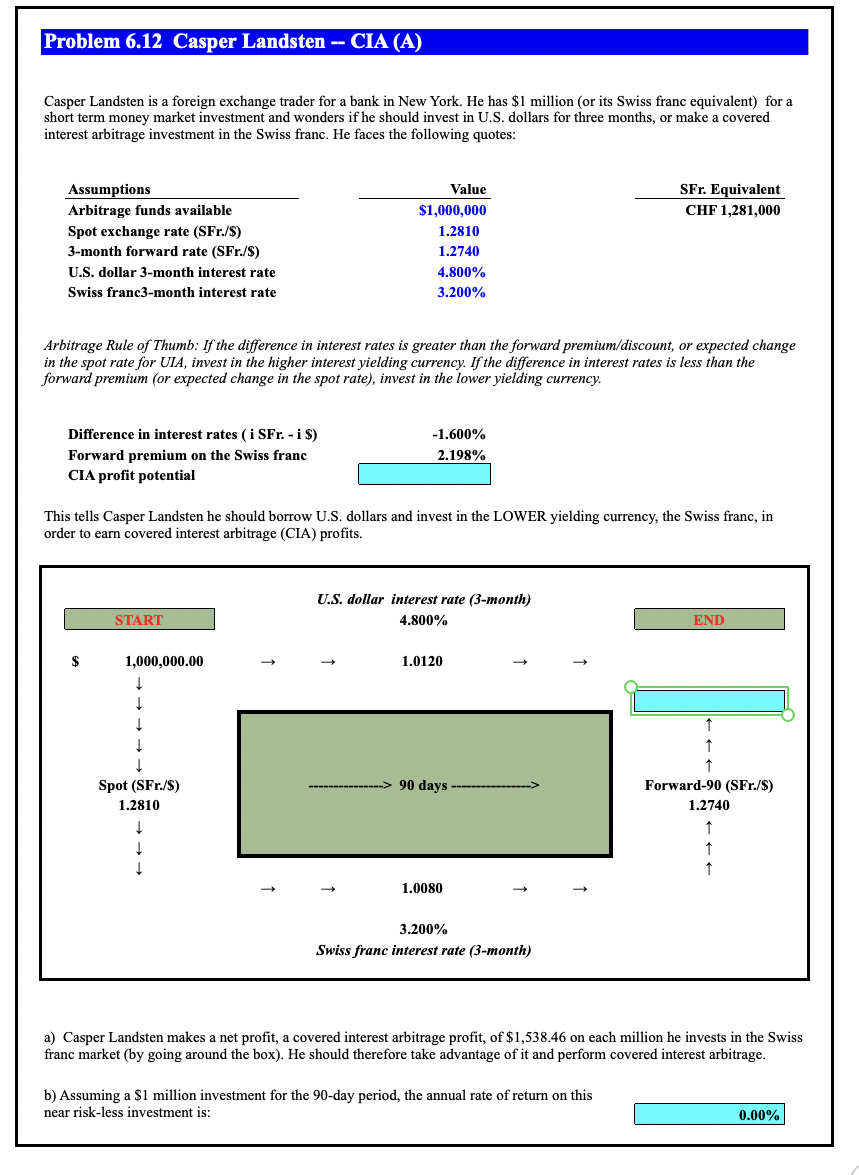

Problem 6.12 Casper Landsten -- CIA (A) Casper Landsten is a foreign exchange trader for a bank in New York. He has $1 million (or its Swiss franc equivalent) for a short term money market investment and wonders if he should invest in U.S. dollars for three months, or make a covered interest arbitrage investment in the Swiss franc. He faces the following quotes: SFr. Equivalent CHF 1,281,000 Assumptions Arbitrage funds available Spot exchange rate (SFr./8) 3-month forward rate (SFr./S) U.S. dollar 3-month interest rate Swiss franc3-month interest rate Value $1,000,000 1.2810 1.2740 4.800% 3.200% Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount, or expected change in the spot rate for UIA, invest in the higher interest yielding currency. If the difference in interest rates is less than the forward premium (or expected change in the spot rate), invest in the lower yielding currency. -1.600% Difference in interest rates ( i SFr.-i $) Forward premium on the Swiss franc CIA profit potential 2.198% This tells Casper Landsten he should borrow U.S. dollars and invest in the LOWER yielding currency, the Swiss franc, in order to earn covered interest arbitrage (CIA) profits. U.S. dollar interest rate (3-month) 4.800% START END $ 1,000,000.00 1.0120 Spot (SFr./S) 1.2810 90 days Forward-90 (SFr./S) 1.2740 1 1 + 1.0080 3.200% Swiss franc interest rate (3-month) a) Casper Landsten makes a net profit, a covered interest arbitrage profit, of $1,538.46 on each million he invests in the Swiss franc market (by going around the box). He should therefore take advantage of it and perform covered interest arbitrage. b) Assuming a $1 million investment for the 90-day period, the annual rate of return on this near risk-less investment is: 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts