Question: Problem 6-15 Project NPV and IRR A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of

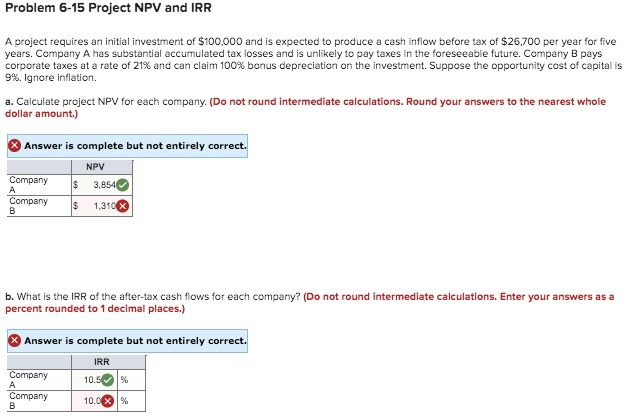

Problem 6-15 Project NPV and IRR A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $26,700 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 9%. Ignore inflation. a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) * Answer is complete but not entirely correct. NPV Company $ 3.854 Company $ 1,310 b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.) Company Company Answer is complete but not entirely correct. IRR 10.5 % 10.0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts