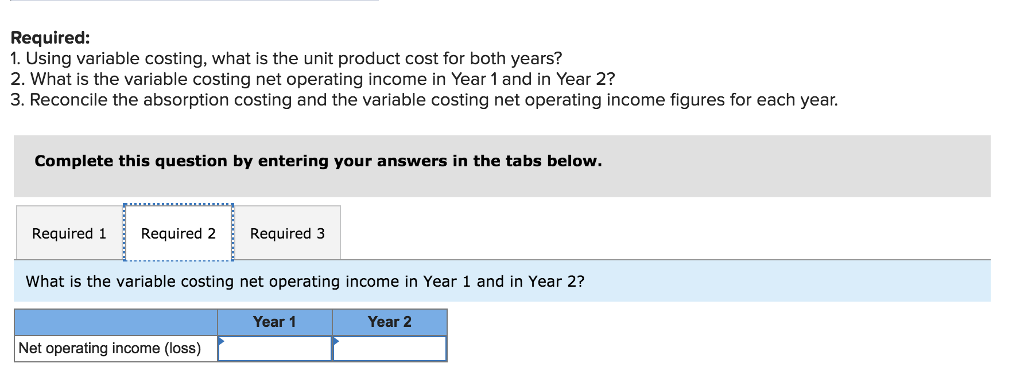

Question: Problem 6-19 Variable Costing Income Statement; Reconciliation [LO6-2, LO6-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as

![Problem 6-19 Variable Costing Income Statement; Reconciliation [LO6-2, LO6-3] During Heaton](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3c8c0f3b41_09666e3c8c066327.jpg)

Problem 6-19 Variable Costing Income Statement; Reconciliation [LO6-2, LO6-3] During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows Year 1 $ 1,024,000 Year 2 Sales ( $64 per unit) Cost of goods sold (e $42 per unit) Gross margin Selling and administrative expenses* Net operating income $ 1,664,000 672,000 110921000 572,000 303,000333,000 s 149,000239,000 352,000 *$3 per unit variable; $255,000 fixed each year. The company's $42 unit product cost is computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($378,000 21,000 units) Absorption costing unit product cost 18 $ 42 Forty percent of fixed manufacturing overhead consists of wages and salaries, the remainder consists of depreciation charges on production equipment and buildings Production and cost data for the first two years of operatons are Units produced Units sold Year 1 Year 2 21,000 21,000 16,000 26, 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts