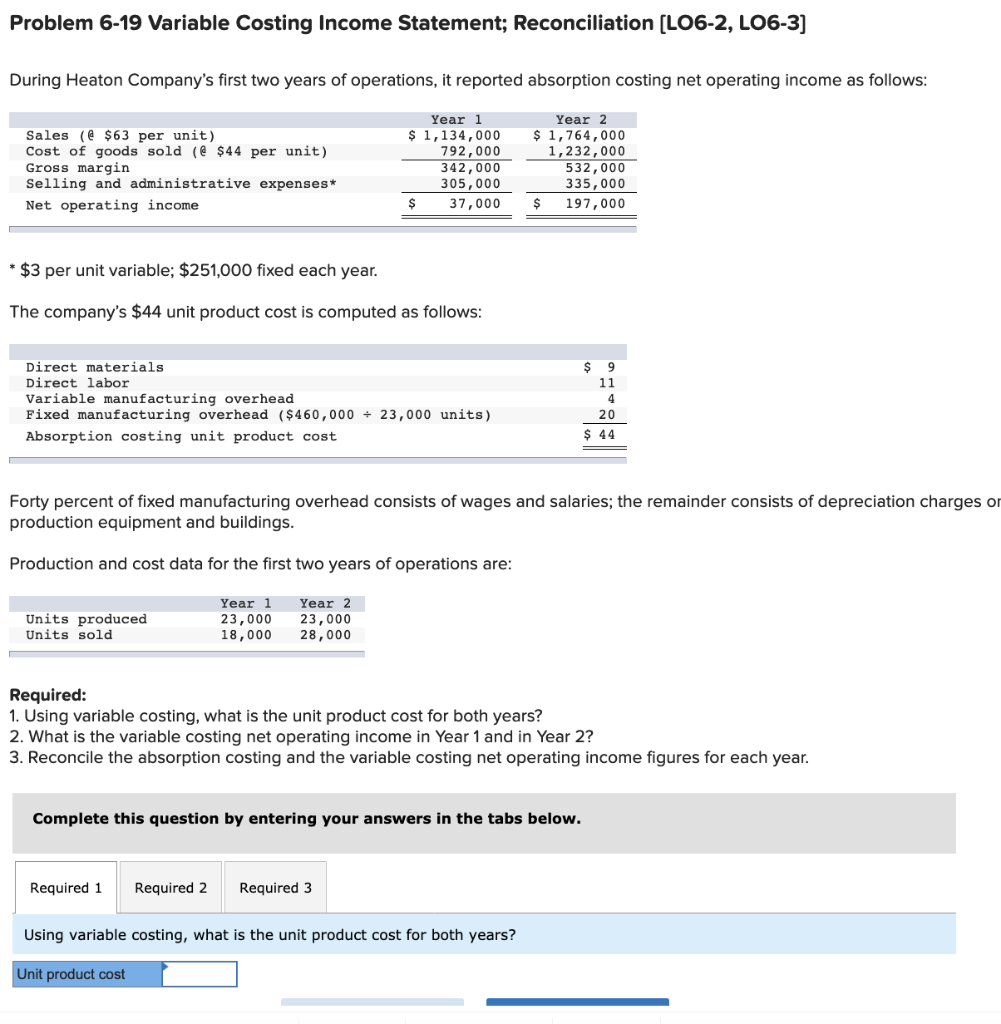

Question: Problem 6-19 Variable Costing Income Statement; Reconciliation (LO6-2, LO6-3) During Heaton Company's first two years of operations, it reported absorption costing net operating income as

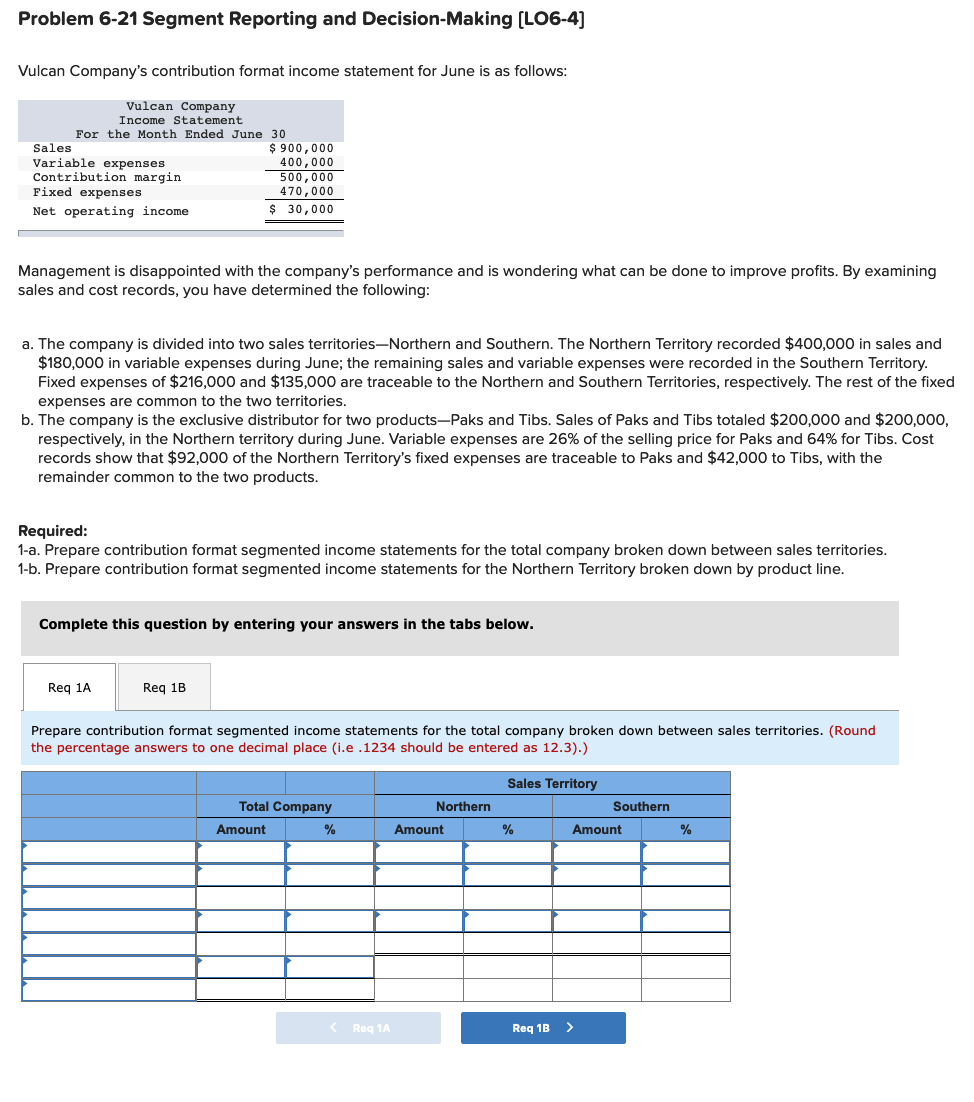

Problem 6-19 Variable Costing Income Statement; Reconciliation (LO6-2, LO6-3) During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales (@ $63 per unit) Cost of goods sold (@ $44 per unit) Gross margin Selling and administrative expenses* Net operating income Year 1 $ 1,134,000 792,000 342,000 305,000 $ 37,000 Year 2 $1,764,000 1,232,000 532,000 335,000 $ 197,000 * $3 per unit variable; $251,000 fixed each year. The company's $44 unit product cost is computed as follows: 17 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($ 460,000 + 23,000 units) Absorption costing unit product cost Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges or production equipment and buildings. Production and cost data for the first two years of operations are: Units produced Units sold Year 1 23,000 18,000 Year 2 23,000 28,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using variable costing, what is the unit product cost for both years? Unit product cost Problem 6-21 Segment Reporting and Decision-Making (LO6-4) Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales $ 900,000 Variable expenses 400,000 Contribution margin 500,000 Fixed expenses 470,000 Net operating income $ 30,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $180,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $216,000 and $135,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $200,000 and $200,000, respectively, in the Northern territory during June. Variable expenses are 26% of the selling price for Paks and 64% for Tibs. Cost records show that $92,000 of the Northern Territory's fixed expenses are traceable to Paks and $42,000 to Tibs, with the remainder common to the two products. Required: 1-a. Prepare contribution format segmented income statements for the total company broken down between sales territories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Prepare contribution format segmented income statements for the total company broken down between sales territories. (Round the percentage answers to one decimal place (i.e .1234 should be entered as 12.3).) Total Company Amount % Northern Amount Sales Territory Southern % Amount % ( Reg 1A Req 1B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts