Question: Problem 6-20 (LO. 6) In the current year, Bill Parker is considering making an investment of $60,000 in Best Choice Partnership. The prospectus provided by

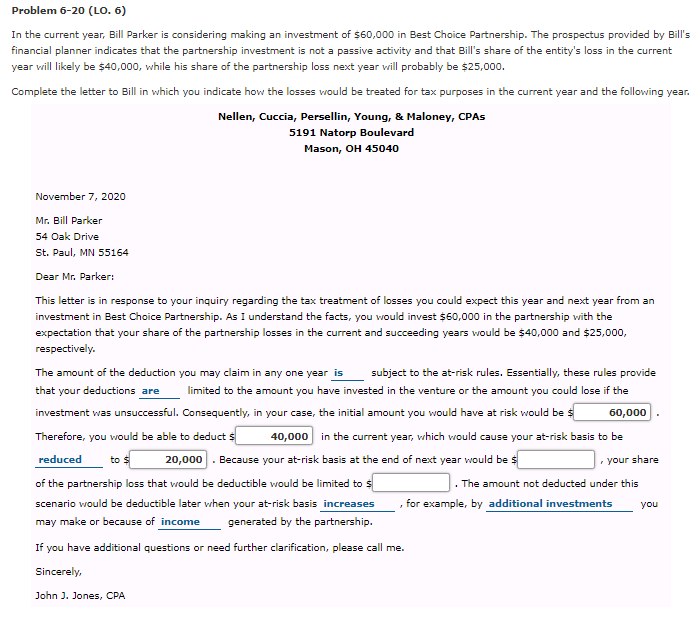

Problem 6-20 (LO. 6) In the current year, Bill Parker is considering making an investment of $60,000 in Best Choice Partnership. The prospectus provided by Bill's financial planner indicates that the partnership investment is not a passive activity and that Bill's share of the entity's loss in the current year will likely be $40,000, while his share of the partnership loss next year will probably be $25,000. Complete the letter to Bill in which you indicate how the losses would be treated for tax purposes in the current year and the following year. Nellen, Cuccia, Persellin, Young, & Maloney, CPAS 5191 Natorp Boulevard Mason, OH 45040 November 7, 2020 Mr. Bill Parker 54 Oak Drive St. Paul, MN 55164 Dear Mr. Parker: This letter is in response to your inquiry regarding the tax treatment of losses you could expect this year and next year from an investment in Best Choice Partnership. As I understand the facts, you would invest $60,000 in the partnership with the expectation that your share of the partnership losses in the current and succeeding years would be $40,000 and $25,000, respectively. The amount of the deduction you may claim in any one year is subject to the at-risk rules. Essentially, these rules provide that your deductions are limited to the amount you have invested in the venture or the amount you could lose if the investment was unsuccessful. Consequently, in your case, the initial amount you would have at risk would be $ 60,000 Therefore, you would be able to deducts 40,000 in the current year, which would cause your at-risk basis to be reduced to $ 20,000. Because your at-risk basis at the end of next year would be s your share of the partnership loss that would be deductible would be limited to s The amount not deducted under this scenario would be deductible later when your at-risk basis increases for example, by additional investments may make or because of income generated by the partnership. If you have additional questions or need further clarification, please call me. Sincerely, you John J. Jones, CPA Problem 6-20 (LO. 6) In the current year, Bill Parker is considering making an investment of $60,000 in Best Choice Partnership. The prospectus provided by Bill's financial planner indicates that the partnership investment is not a passive activity and that Bill's share of the entity's loss in the current year will likely be $40,000, while his share of the partnership loss next year will probably be $25,000. Complete the letter to Bill in which you indicate how the losses would be treated for tax purposes in the current year and the following year. Nellen, Cuccia, Persellin, Young, & Maloney, CPAS 5191 Natorp Boulevard Mason, OH 45040 November 7, 2020 Mr. Bill Parker 54 Oak Drive St. Paul, MN 55164 Dear Mr. Parker: This letter is in response to your inquiry regarding the tax treatment of losses you could expect this year and next year from an investment in Best Choice Partnership. As I understand the facts, you would invest $60,000 in the partnership with the expectation that your share of the partnership losses in the current and succeeding years would be $40,000 and $25,000, respectively. The amount of the deduction you may claim in any one year is subject to the at-risk rules. Essentially, these rules provide that your deductions are limited to the amount you have invested in the venture or the amount you could lose if the investment was unsuccessful. Consequently, in your case, the initial amount you would have at risk would be $ 60,000 Therefore, you would be able to deducts 40,000 in the current year, which would cause your at-risk basis to be reduced to $ 20,000. Because your at-risk basis at the end of next year would be s your share of the partnership loss that would be deductible would be limited to s The amount not deducted under this scenario would be deductible later when your at-risk basis increases for example, by additional investments may make or because of income generated by the partnership. If you have additional questions or need further clarification, please call me. Sincerely, you John J. Jones, CPA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts