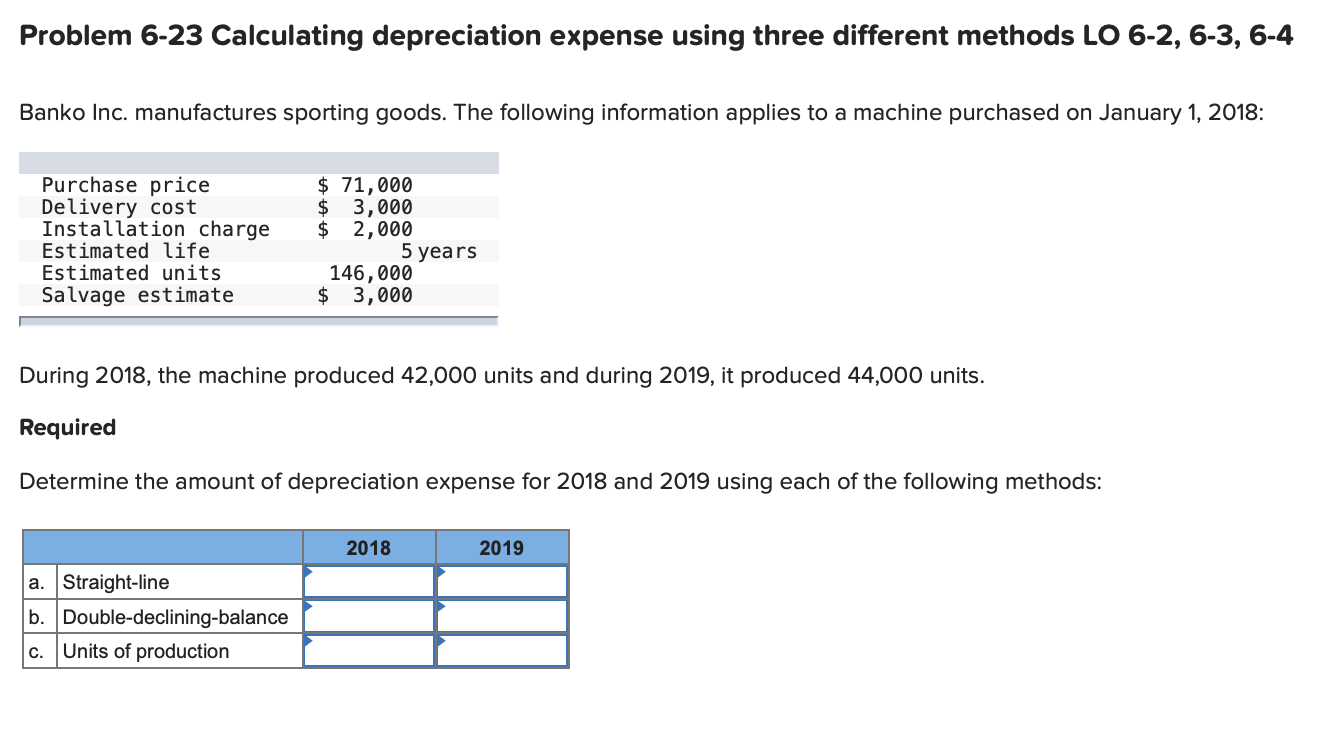

Question: Problem 6-23 Calculating depreciation expense using three different methods LO 6-2, 6-3, 6-4 Banko Inc. manufactures sporting goods. The following information applies to a machine

Problem 6-23 Calculating depreciation expense using three different methods LO 6-2, 6-3, 6-4 Banko Inc. manufactures sporting goods. The following information applies to a machine purchased on January 1, 2018: Purchase price Delivery cost Installation charge Estimated life Estimated units Salvage estimate $ 71,000 $ 3,000 $ 2,000 5 years 146,000 $ 3,000 During 2018, the machine produced 42,000 units and during 2019, it produced 44,000 units. Required Determine the amount of depreciation expense for 2018 and 2019 using each of the following methods: 2018 2019 a. Straight-line b. Double-declining-balance c. Units of production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts