Question: Problem 6-31 (algorithmic) 4 Show Work Question Help A new manufacturing facility will produce two products, each of which requires a drilling operation during processing.

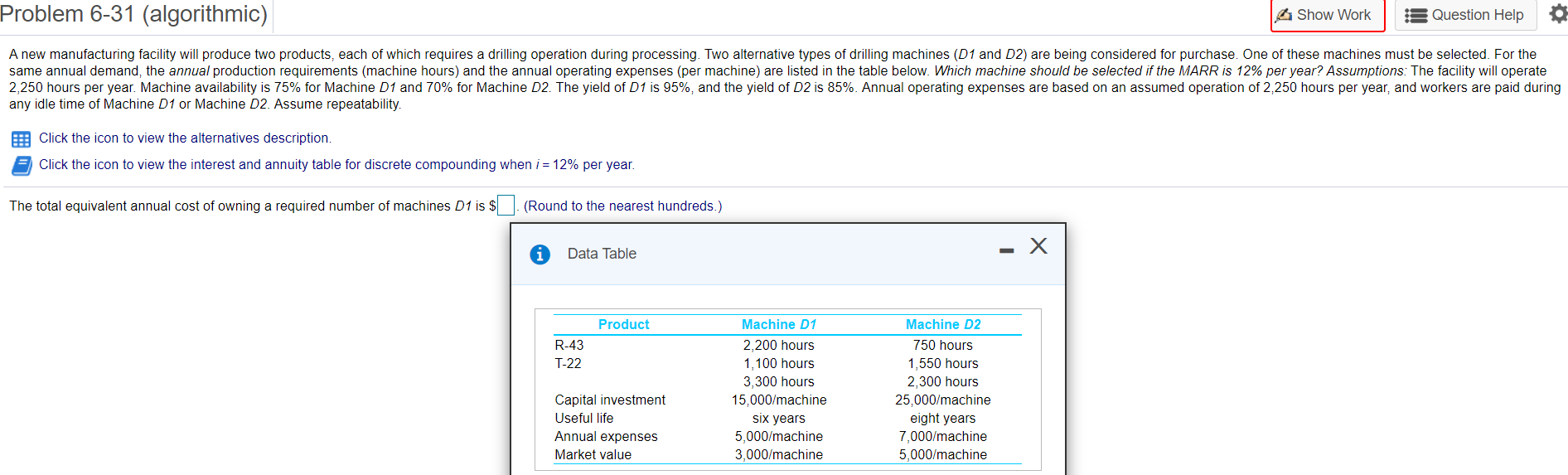

Problem 6-31 (algorithmic) 4 Show Work Question Help A new manufacturing facility will produce two products, each of which requires a drilling operation during processing. Two alternative types of drilling machines (D1 and D2) are being considered for purchase. One of these machines must be selected. For the same annual demand, the annual production requirements (machine hours) and the annual operating expenses (per machine) are listed in the table below. Which machine should be selected if the MARR is 12% per year? Assumptions: The facility will operate 2,250 hours per year. Machine availability is 75% for Machine D1 and 70% for Machine D2. The yield of D1 is 95%, and the yield of D2 is 85%. Annual operating expenses are based on an assumed operation of 2,250 hours per year, and workers are paid during any idle time of Machine D1 or Machine D2. Assume repeatability. Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when i = 12% per year. The total equivalent annual cost of owning a required number of machines D1 is $ (Round to the nearest hundreds.) Data Table X Product R-43 T-22 Machine D1 2,200 hours 1,100 hours 3,300 hours 15,000/machine six years 5,000/machine 3,000/machine Machine D2 750 hours 1,550 hours 2,300 hours 25,000/machine eight years 7,000/machine 5,000/machine Capital investment Useful life Annual expenses Market value Problem 6-31 (algorithmic) 4 Show Work Question Help A new manufacturing facility will produce two products, each of which requires a drilling operation during processing. Two alternative types of drilling machines (D1 and D2) are being considered for purchase. One of these machines must be selected. For the same annual demand, the annual production requirements (machine hours) and the annual operating expenses (per machine) are listed in the table below. Which machine should be selected if the MARR is 12% per year? Assumptions: The facility will operate 2,250 hours per year. Machine availability is 75% for Machine D1 and 70% for Machine D2. The yield of D1 is 95%, and the yield of D2 is 85%. Annual operating expenses are based on an assumed operation of 2,250 hours per year, and workers are paid during any idle time of Machine D1 or Machine D2. Assume repeatability. Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when i = 12% per year. The total equivalent annual cost of owning a required number of machines D1 is $ (Round to the nearest hundreds.) Data Table X Product R-43 T-22 Machine D1 2,200 hours 1,100 hours 3,300 hours 15,000/machine six years 5,000/machine 3,000/machine Machine D2 750 hours 1,550 hours 2,300 hours 25,000/machine eight years 7,000/machine 5,000/machine Capital investment Useful life Annual expenses Market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts