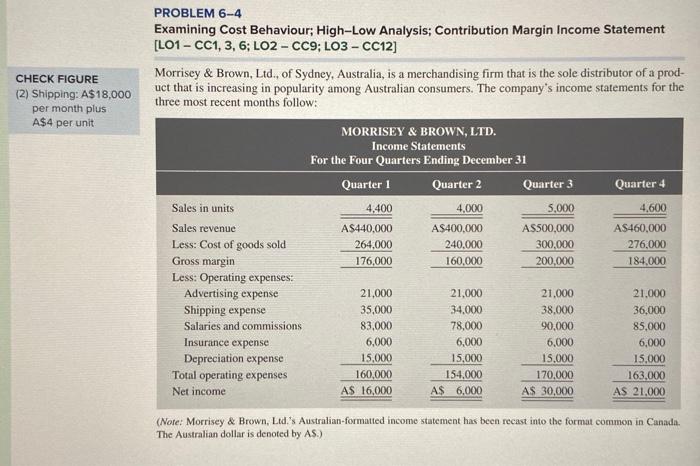

Question: PROBLEM 6-4 Examining Cost Behaviour; High-Low Analysis; Contribution Margin Income Statement [LO1 - CC1, 3, 6; LO2 - CC9; LO3 - CC12] CHECK FIGURE Morrisey

![[LO1 - CC1, 3, 6; LO2 - CC9; LO3 - CC12] CHECK](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e97feed1600_67066e97fee6dbdf.jpg)

PROBLEM 6-4 Examining Cost Behaviour; High-Low Analysis; Contribution Margin Income Statement [LO1 - CC1, 3, 6; LO2 - CC9; LO3 - CC12] CHECK FIGURE Morrisey \& Brown, Ltd., of Sydney, Australia, is a merchandising firm that is the sole distributor of a prod- (2) Shipping: A\$18,000 uct that is increasing in popularity among Australian consumers. The company's income statements for the per month plus A\$4 per unit. (Note: Morrisey \& Brown, Ltd.'s Australian-formatted income statement has been recast into the format common in Canada. The Australian dollar is denoted by AS.) Required: 1. Identify each of the company's expenses (including cost of goods sold) as being variable, fixed, or mixed. 2. Using the high-low method, separate each mixed expense into variable and fixed elements. State the cost formula for each mixed expense. 3. Redo the company's income statement at the 5,000 -unit level of activity using the contribution format. 4. Assume that the company's sales are projected to be 4,500 units in the next quarter. Prepare a contribution margin income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts