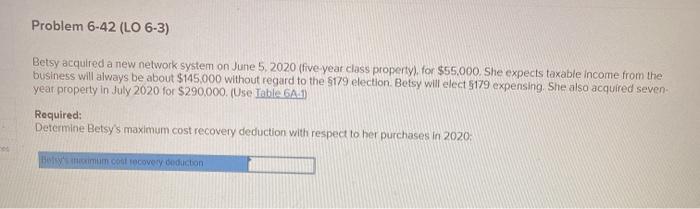

Question: Problem 6-42 (LO 6-3) Betsy acquired a new network system on June 5, 2020 (five-year class property) for $55,000. She expects taxable income from the

Problem 6-42 (LO 6-3) Betsy acquired a new network system on June 5, 2020 (five-year class property) for $55,000. She expects taxable income from the business will always be about $145.000 without regard to the $179 election Betsy will elect 5179 expensing. She also acquired seven year property in July 2020 for $290,000. (Use Table 6A1 Required: Determine Betsy's maximum cost recovery deduction with respect to her purchases in 2020, Blommorocovery deduction Problem 6-42 (LO 6-3) Betsy acquired a new network system on June 5, 2020 (five-year class property) for $55,000. She expects taxable income from the business will always be about $145.000 without regard to the $179 election Betsy will elect 5179 expensing. She also acquired seven year property in July 2020 for $290,000. (Use Table 6A1 Required: Determine Betsy's maximum cost recovery deduction with respect to her purchases in 2020, Blommorocovery deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts