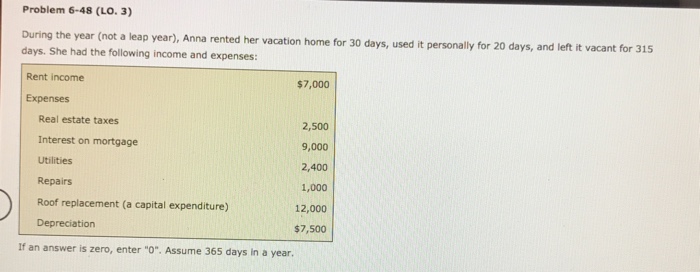

Question: Problem 6-48 (LO. 3) During the year (not a leap year), Anna rented her vacation home for 30 days, used it personally for 20 days,

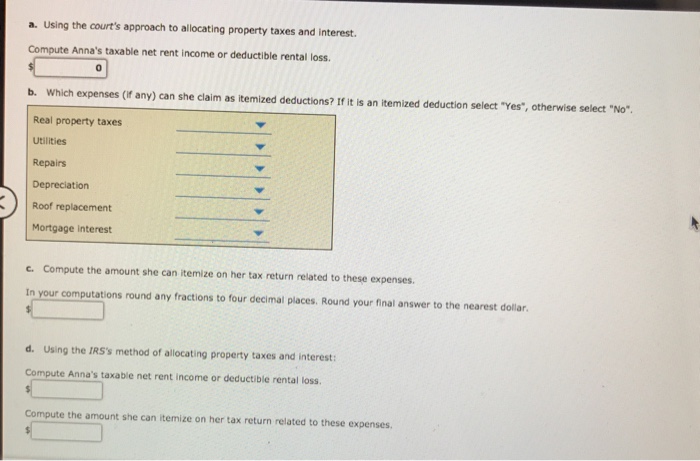

Problem 6-48 (LO. 3) During the year (not a leap year), Anna rented her vacation home for 30 days, used it personally for 20 days, and left it vacant for 315 days. She had the following income and expenses: Rent income $7,000 Expenses Real estate taxes 2,500 Interest on mortgage 9,000 2,400 Repairs 1,000 Roof replacement (a capital expenditure) 12,000 Depreciation $7,500 If an answer is zero, enter "o". Assume 365 days in a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts