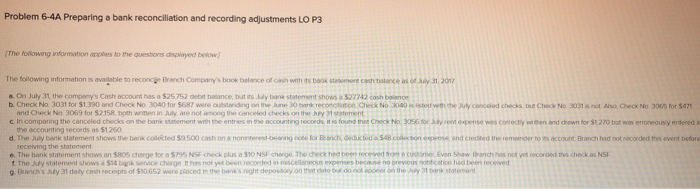

Question: Problem 6-4A Preparing a bank reconciliation and recording adjustments LO P3 The following information s to the questions de The following information is available to

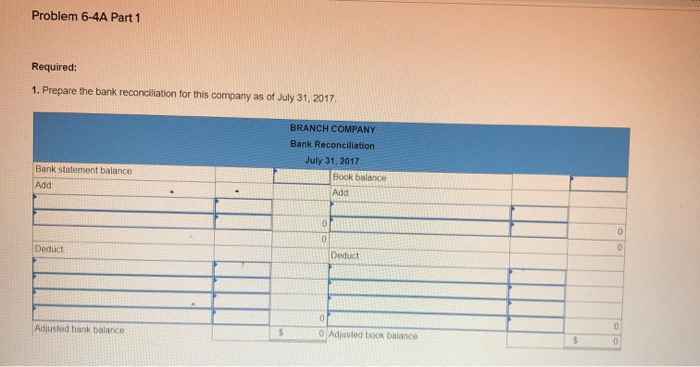

Problem 6-4A Preparing a bank reconciliation and recording adjustments LO P3 The following information s to the questions de The following information is available to recor d Com b o with montanhance of 31 2017 a. On July 31 the company's Cash account has a $25.752 debit balance, but its bank statement shows $27742 cash belone b. Check No 3031 for $1.390 and Check No 3040 for $687 were t ing on the nebank reconcion Check No 300 sted with the coded ched the No 3031 is not so Check No 305 for 5471 and Chuck No 3069 for $2.158 bith written in de not r e rechecks on the woment c. In comparing the canceled checks on the bank statement entre out r os found the comedy and drawn for $1270 but was erroneousy entered the accounting records as $1260 d. The bank statement shows the bankcooked schon amon g for a dedica 54coon and the count Branch had to recorded this event before receiving the statement . The bank statement shows on soos charge for 5745 NSE chock clusa s10Nsf charge. The checkhoe been recevedono contortor even show bronchineas not yet recorond this check as NSF D y ch recept of 50652 wurde onde Problem 6-4A Part 1 Required: 1. Prepare the bank reconciliation for this company as of July 31, 2017 BRANCH COMPANY Bank Reconciliation July 31, 2017 Book balance Bank statement balance Add Deduct Adjusted bank balance 5 0 Adjusted book balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts