Question: Problem 6-5 Bond Pricing (L01, 2) A General Power bond carries a coupon rate of 9.2%, has 9 years until maturity, and sells at a

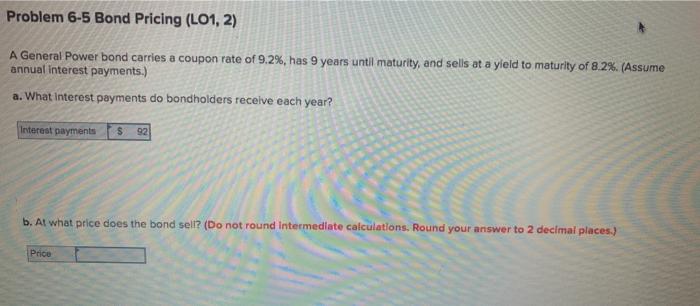

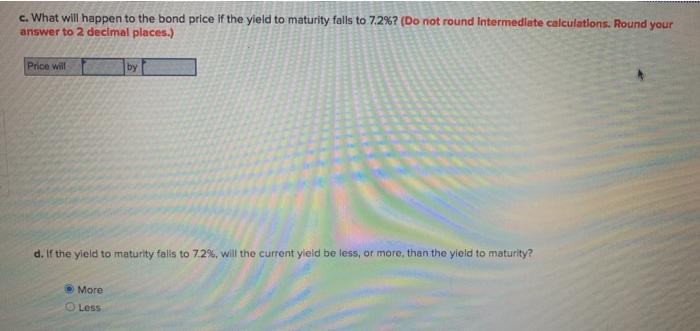

Problem 6-5 Bond Pricing (L01, 2) A General Power bond carries a coupon rate of 9.2%, has 9 years until maturity, and sells at a yield to maturity of 8.2%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? Interest payments $ 92 b. At what price does the bond sell? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts