Question: Problem 6-5 Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 22%. T-bills offer a risk- free

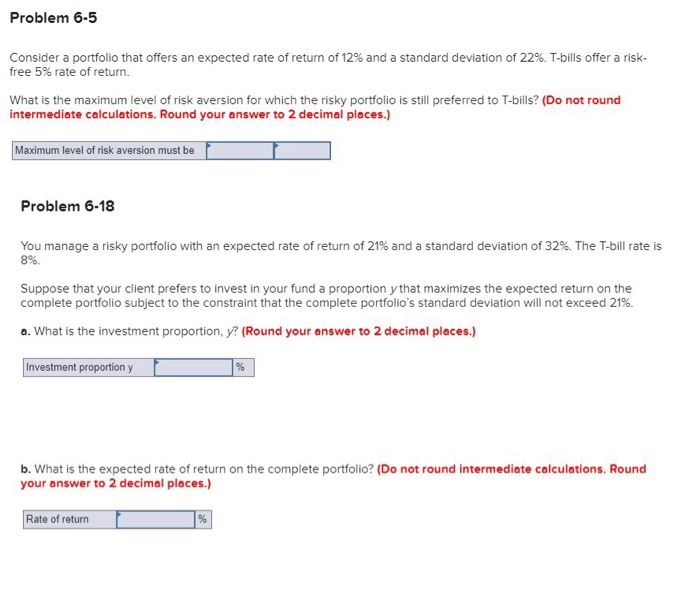

Problem 6-5 Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 22%. T-bills offer a risk- free 5% rate of return. What is the maximum level of risk aversion for which the risky portfolio is stll preferred to T-bills? (Do not round intermediate calculations. Round your answer to 2 decimeal places.) Maximum level of risk aversion must be Problem 6-18 You manage a risky portfolio with an expected rate of return of 21% and a standard deviation of 32 %. The T-bill rate is 8%. Suppose that your client prefers to invest in your fund a proportion ythat maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio's standard deviation will not exceed 21 %. a. What is the investment proportion, y (Round your answer to 2 decimal places.) Investment proportion y % b. What is the expected rate of return on the complete portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Rate of return %6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts