Question: Problem 6-59 The Orion Corp. is evaluating a proposal for a new project. It will cost $50,000 to get the undertaking started. The project will

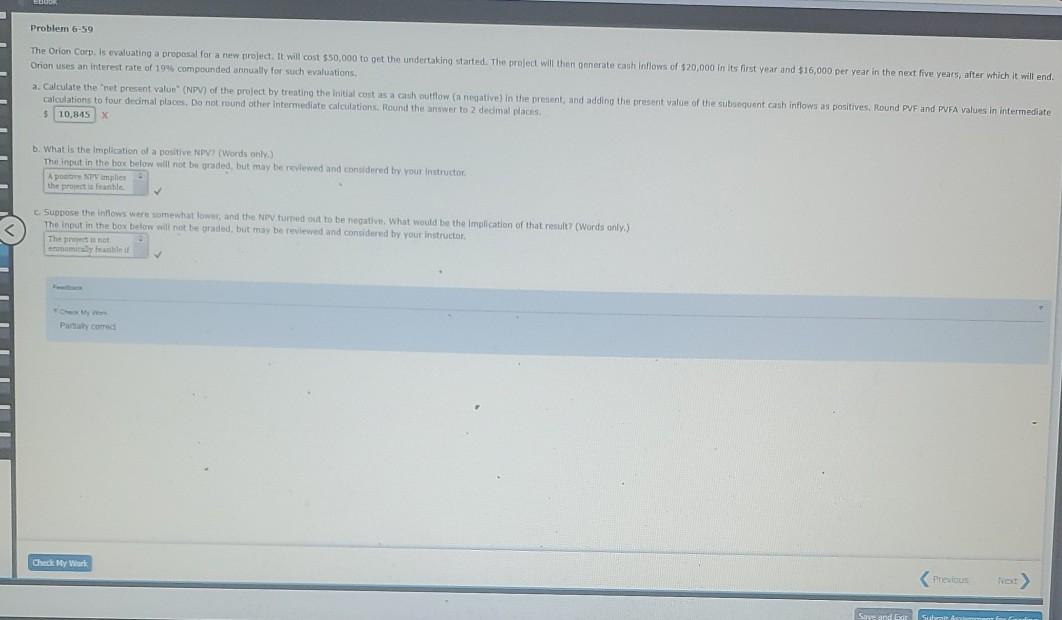

Problem 6-59 The Orion Corp. is evaluating a proposal for a new project. It will cost $50,000 to get the undertaking started. The project will then generate cash Intlows of $20,000 in its first year and 516,000 per year in the next five years, after which it will end. Orion uses an interest rate of 199 compounded annually for such evaluations, a. Calculate the net present value (NPV) of the project by treating the initial cost is a ash outflow (a negative in the present and adding the present value of the subsequent cash inflows as positives. Round PVF and PUFA values in intermediate calculations to four domal places. Do not round other intermediate calculations. Round the answer to 2 dedmal aces $ 10,845 x b. What is the implication of a positive NPV (Words only) The input in the box below will not be red, but may be reviewed and considered try your instructor ANTV implies B ther pros ante c. Suppose the inflows were somewhat low, and the NPV turned out to be negative. What would be the implication of that result? (Words only) The input in the box below will not be traded but may be reviewed and considered by your instructor Thement Parco Ched My Work Previous Sand Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts