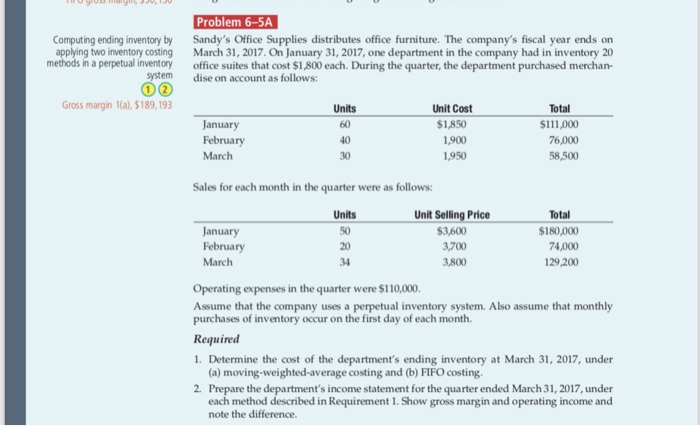

Question: Problem 6-5A Computing ending inventory by applying two inventory costing methods in a perpetual inventory system Sandy's Office Supplies distributes office furniture. The company's fiscal

Problem 6-5A Computing ending inventory by applying two inventory costing methods in a perpetual inventory system Sandy's Office Supplies distributes office furniture. The company's fiscal year ends on March 31, 2017. On January 31, 2017, one department in the company had in inventory 20 office suites that cost $1,800 each. During the quarter, the department purchased merchan- dise on account as follows: Gross margin 1(a),$189,193 Total $111,000 76,000 58,500 Units 60 40 30 Unit Cost $1,850 1,900 1,950 January February March Sales for each month in the quarter were as follows: Total $180,000 74,000 29,200 Units Unit Selling Price $3,600 3,700 3,800 February March 20 34 Operating expenses in the quarter were $110,000. Assume that the company uses a perpetual inventory system. Also assume that monthly purchases of inventory occur on the first day of each month. Required 1. Determine the cost of the department's ending inventory at March 31, 2017, under 2. (a) moving-weighted-average costing and (b) FIFO costing Prepare the department's income statement for the quarter ended March 31, 2017, under each method described in Requirement 1. Show gross margin and operating income and note the difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts