Question: Problem 6-6A (Part Level Submission) You are provided with the following information for Monty Corp. Monty Corp. uses the periodic system of accounting for its

Problem 6-6A (Part Level Submission)

You are provided with the following information for Monty Corp. Monty Corp. uses the periodic system of accounting for its inventory transactions.

| March | 1 | Beginning inventory 2,025 liters at a cost of 59 per liter. | ||

| March | 3 | Purchased 2,405 liters at a cost of 64 per liter. | ||

| March | 5 | Sold 2,295 liters for $1.00 per liter. | ||

| March | 10 | Purchased 4,165 liters at a cost of 71 per liter. | ||

| March | 20 | Purchased 2,585 liters at a cost of 79 per liter. | ||

| March | 30 | Sold 5,275 liters for $1.30 per liter. |

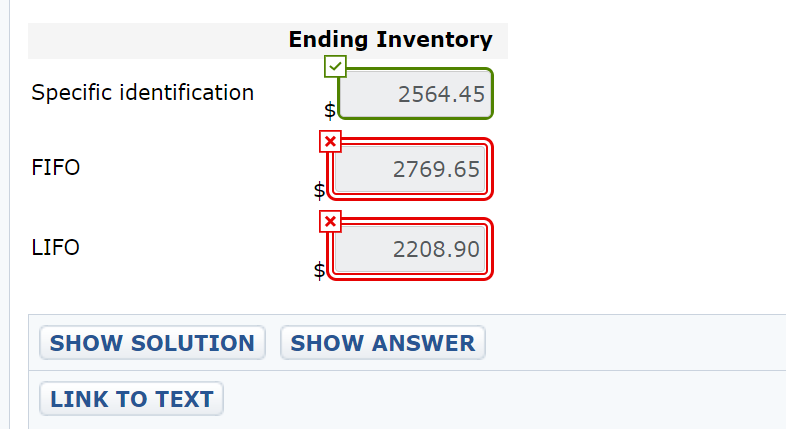

Calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.25.)

(1) Specific identification method assuming:

(i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,295 liters from the March 3 purchase; and

(ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 480 liters from March 1; 595 liters from March 3; 2,900 liters from March 10; 1,300 liters from March 20.

(2) FIFO

(3) LIFO

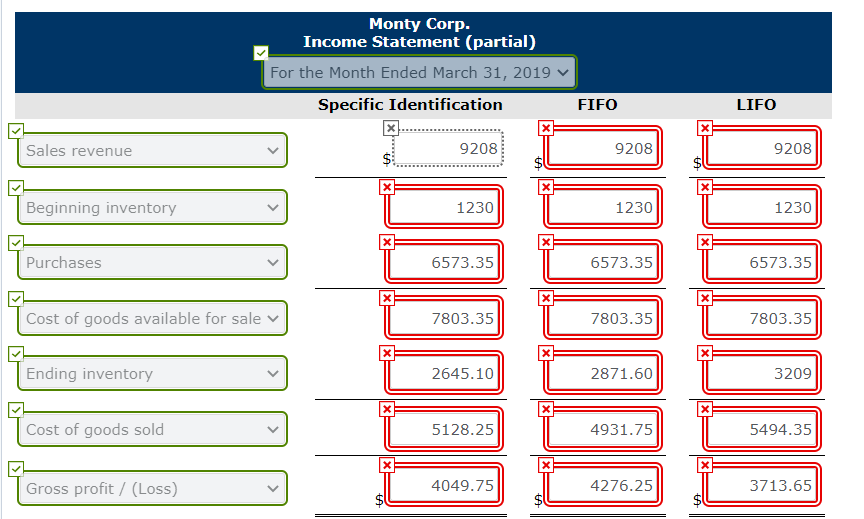

Prepare partial income statements through gross profit, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.25.)

| (1) | Specific identification method assuming: | ||

| (i) | The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,295 liters from the March 3 purchase; and | ||

| (ii) | The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 480 liters from March 1; 595 liters from March 3; 2,900 liters from March 10; 1,300 liters from March 20. | ||

| (2) | FIFO | ||

| (3) | LIFO | ||

Ending Inventory Specific identification 2564.45 $ X FIFO 2769.65 X LIFO 2208.90 SHOW SOLUTION SHOW ANSWER LINK TO TEXT Monty Corp. Income Statement (partial) For the Month Ended March 31, 2019 Specific Identification FIFO LIFO Sales revenue 9208 9208 9208 $ x Beginning inventory 1230 1230 1230 X Purchases 6573.35 6573.35 6573.35 X X Cost of goods available for sale v 7803.35 7803.35 7803.35 X Ending inventory 2645.10 2871.60 3209 Cost of goods sold 5128.25 4931.75 5494.35 X X Gross profit/ (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts