Question: Problem 6-6A Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (L06-2,

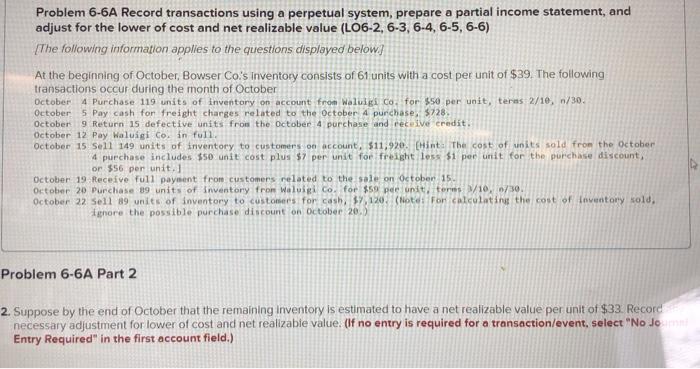

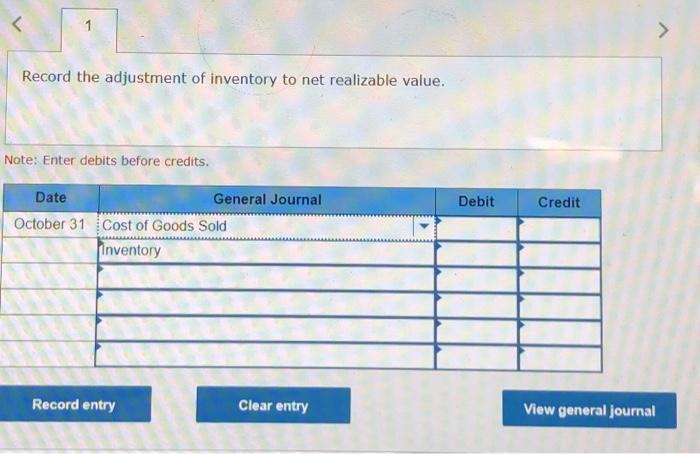

Problem 6-6A Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (L06-2, 6-3, 6-4, 6-5, 6-6) {The following information applies to the questions displayed below) At the beginning of October, Bowser Co's inventory consists of 61 units with a cost per unit of $39. The following transactions occur during the month of October October 4 Purchase 119 units of Inventory on account from Waluigico. for $50 per unit, terns 2/10, 1/30. October 5 Pay cash for freight charges related to the October 4 purchase. $728. October 9 Return 15 defective units from the October 4 purchase and receive credit. October 12 Pay Waluigi Co. in full. October 15 Sell 149 units of Inventory to customers on account, $11.920. Cinta The cost of units sold from the October 4 purchase includes $50 unit cost plus $7 per unit for freight loss 31 per unit for the purchase discount, or $56 per unit. October 19 Receive full payment from customers related to the sale on October 15. October 20 Purchase 39 units of Inventory from Waluigico. for $59 pee unit, torns 10,6730. October 22 5611 89 units of inventory to customers for cash 120 (Mozat For calculating the cost of lovestory sold. ignore the possible purchase discount on October 20.) Problem 6-6A Part 2 2. Suppose by the end of October that the remaining inventory is estimated to have a net realizable value per unit of $33. Record necessary adjustment for lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No jo Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts