Question: Problem 6-6B Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value(LO6-2, 6-3,

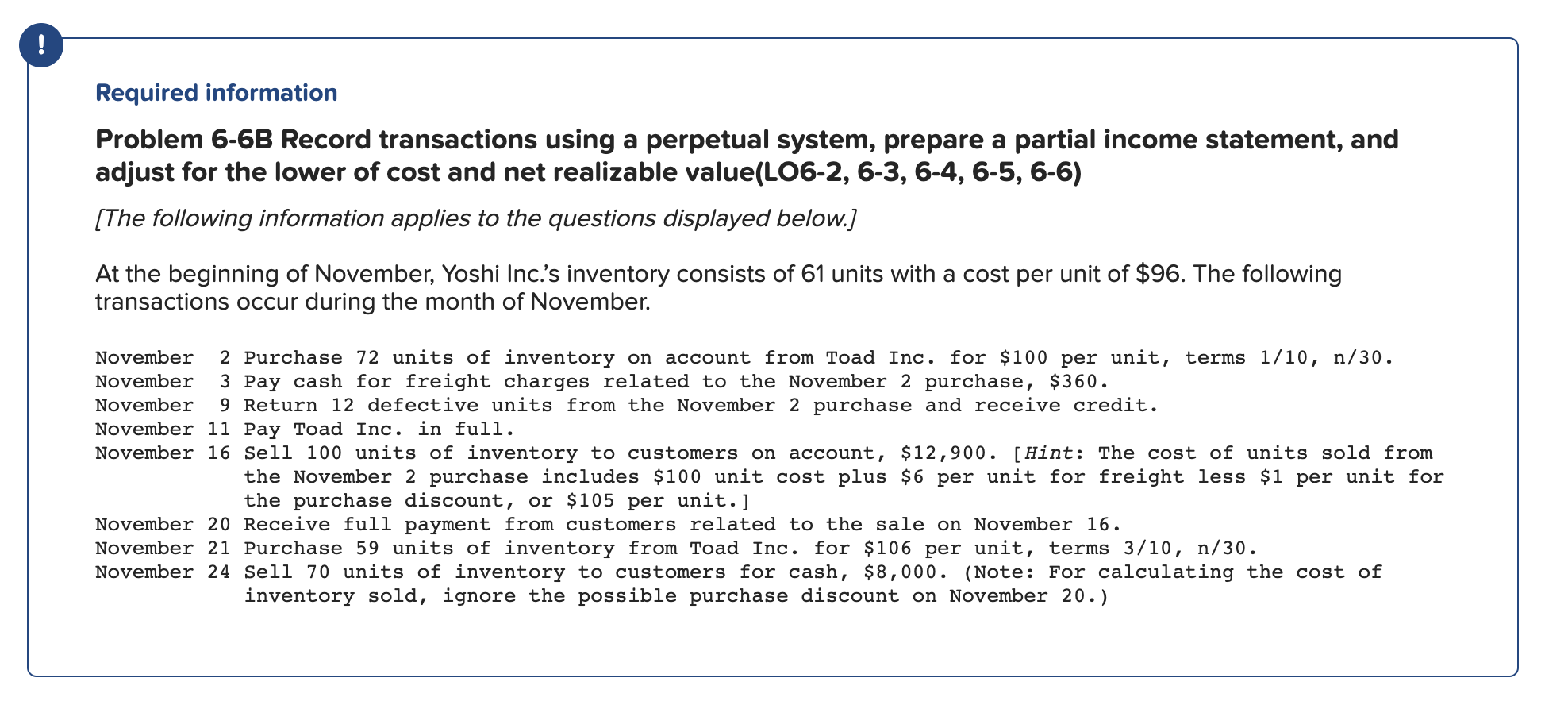

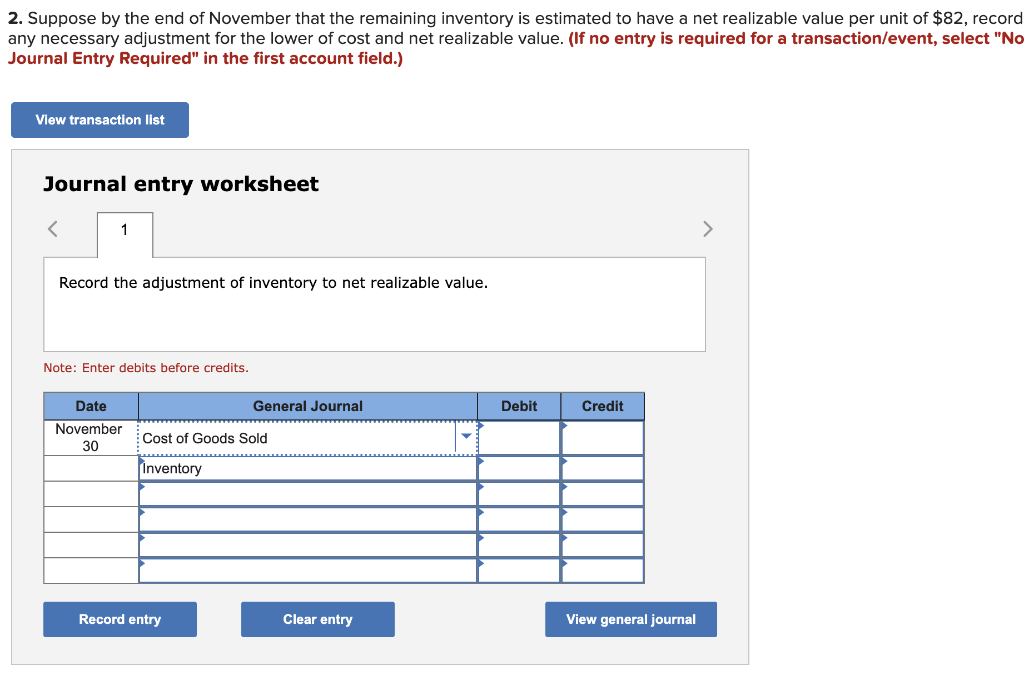

Problem 6-6B Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value(LO6-2, 6-3, 6-4, 6-5, 6-6) Skip to question [The following information applies to the questions displayed below.] At the beginning of November, Yoshi Inc.s inventory consists of 61 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 72 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $360. November 9 Return 12 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,900. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $6 per unit for freight less $1 per unit for the purchase discount, or $105 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 59 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 70 units of inventory to customers for cash, $8,000. (Note: For calculating the cost of inventory sold, ignore the possible purchase discount on November 20.) rev: 03_03_2020_QC_CS-202947 Problem 6-6B Part 2 2. Suppose by the end of November that the remaining inventory is estimated to have a net realizable value per unit of $82, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

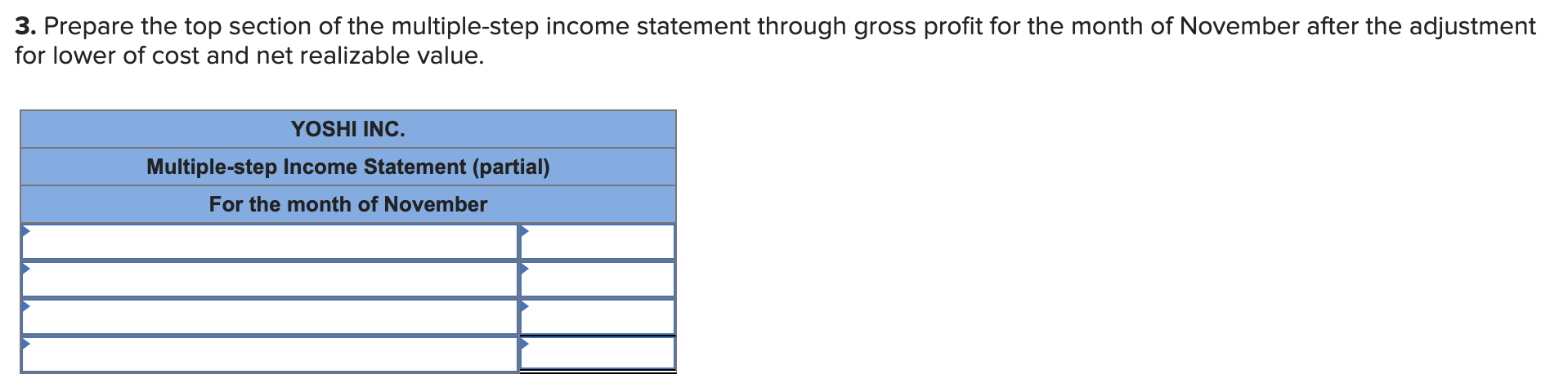

! Required information Problem 6-6B Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value(LO6-2, 6-3, 6-4, 6-5, 6-6) [The following information applies to the questions displayed below.] At the beginning of November, Yoshi Inc.'s inventory consists of 61 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 72 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $360. November 9 Return 12 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,900. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $6 per unit for freight less $1 per unit for the purchase discount, or $105 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 59 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 70 units of inventory to customers for cash, $8,000. (Note: For calculating the cost of inventory sold, ignore the possible purchase discount on November 20.) 2. Suppose by the end of November that the remaining inventory is estimated to have a net realizable value per unit of $82, record any necessary adjustment for the lower of cost and net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the adjustment of inventory to net realizable value. Note: Enter debits before credits. Date General Journal November 30 Cost of Goods Sold Inventory Clear entry Record entry Debit Credit View general journal 3. Prepare the top section of the multiple-step income statement through gross profit for the month of November after the adjustment for lower of cost and net realizable value. YOSHI INC. Multiple-step Income Statement (partial) For the month of November

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts