Question: PROBLEM 6-7 IDENTIFICATION (IAA) Identify the principle or concept that is most clearly violated by the accounting practice described. Do not use any answer more

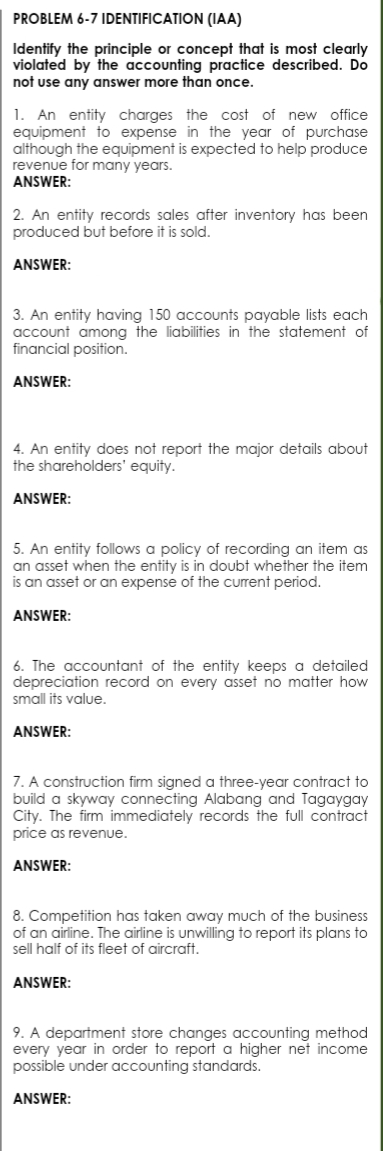

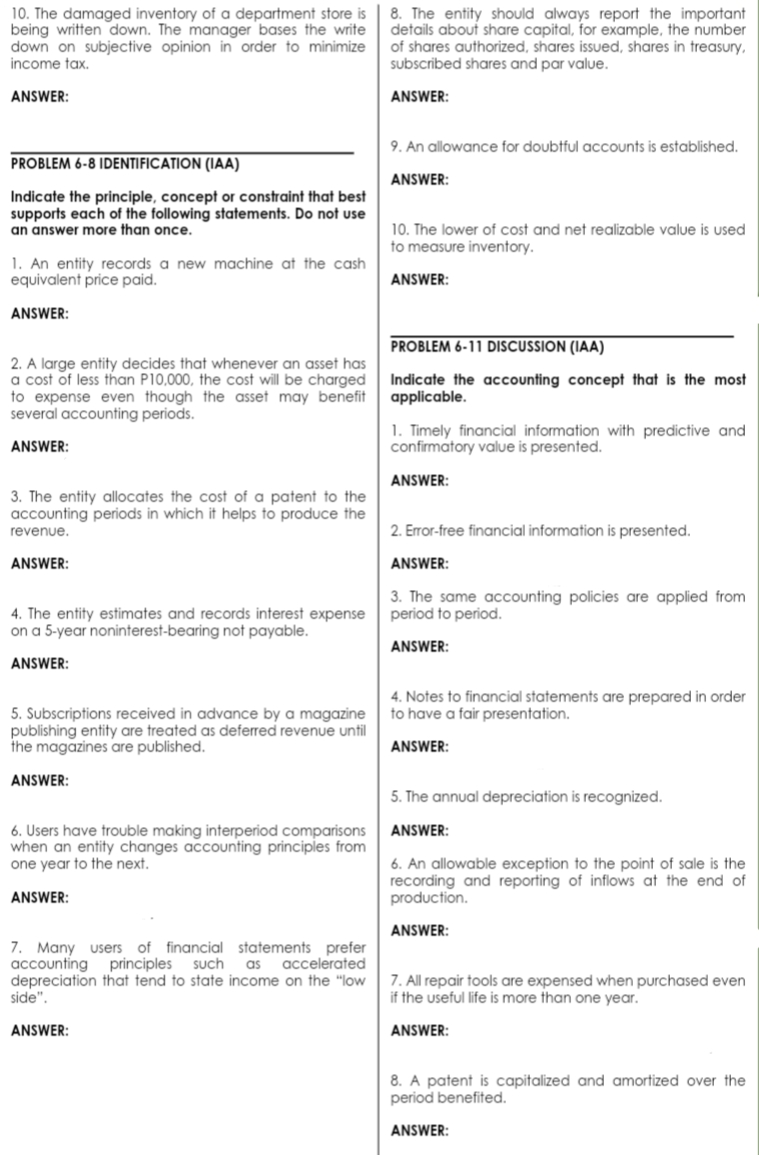

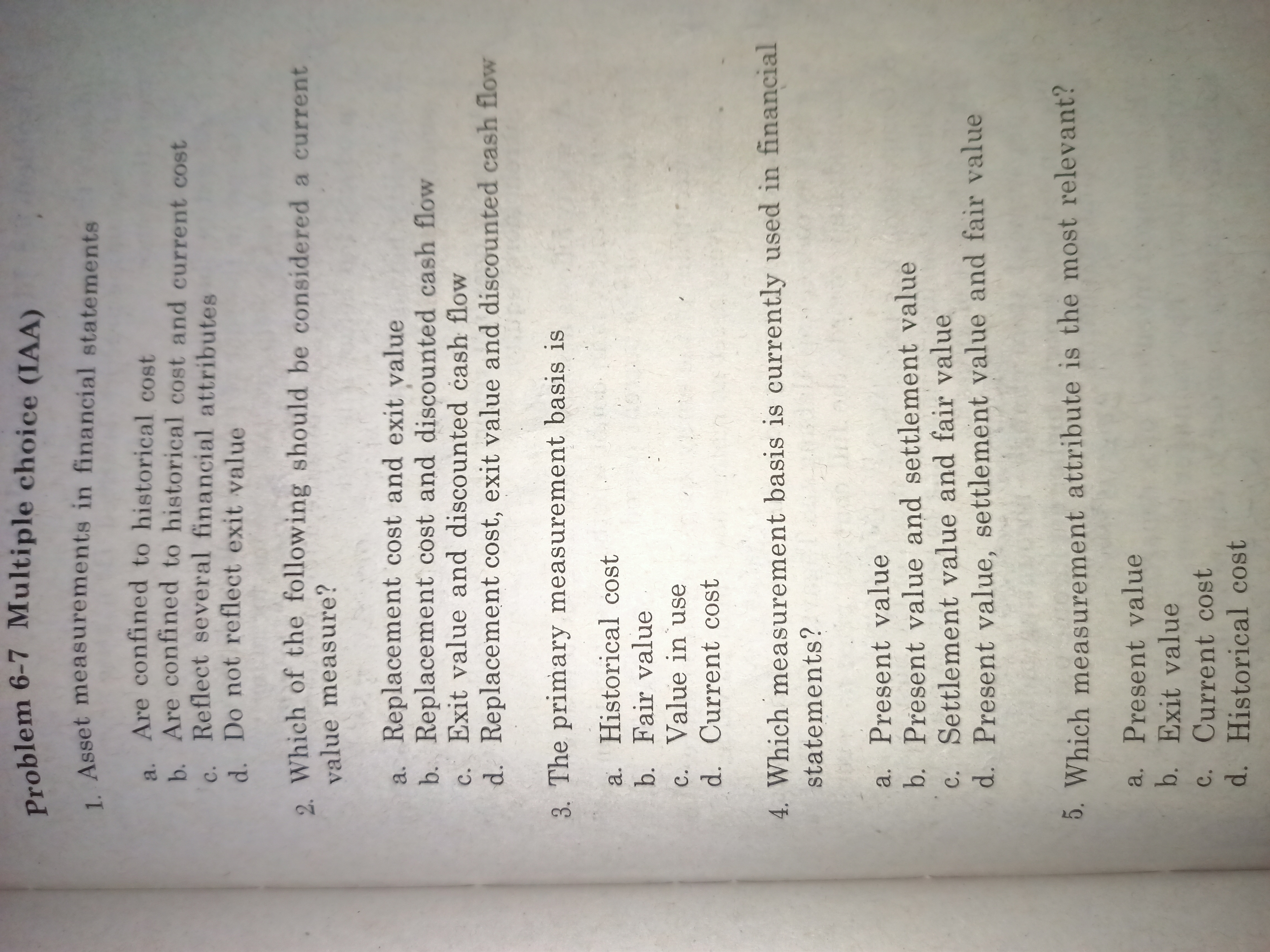

PROBLEM 6-7 IDENTIFICATION (IAA) Identify the principle or concept that is most clearly violated by the accounting practice described. Do not use any answer more than once. 1. An entity charges the cost of new office equipment to expense in the year of purchase although the equipment is expected to help produce revenue for many years. ANSWER: 2. An entity records sales after inventory has been produced but before it is sold. ANSWER: 3. An entity having 150 accounts payable lists each account among the liabilities in the statement of financial position. ANSWER: 4. An entity does not report the major details about the shareholders' equity. ANSWER: 5. An entity follows a policy of recording an item as an asset when the entity is in doubt whether the item is an asset or an expense of the current period. ANSWER: 6. The accountant of the entity keeps a detailed depreciation record on every asset no matter how small its value. ANSWER: 7. A construction firm signed a three-year contract to build a skyway connecting Alabang and Tagaygay City. The firm immediately records the full contract price as revenue. ANSWER: 8. Competition has taken away much of the business of an airline. The airline is unwilling to report its plans to sell half of its fleet of aircraft. ANSWER: 9. A department store changes accounting method every year in order to report a higher net income possible under accounting standards. ANSWER:10. The damaged inventory of a department store is 8. The entity should always report the important being written down. The manager bases the write details about share capital, for example, the number down on subjective opinion in order to minimize of shares authorized, shares issued, shares in treasury, income tax. subscribed shares and par value. ANSWER: ANSWER: 9. An allowance for doubtful accounts is established. PROBLEM 6-8 IDENTIFICATION (IAA) ANSWER: Indicate the principle, concept or constraint that best supports each of the following statements. Do not use an answer more than once. 10. The lower of cost and net realizable value is used to measure inventory. 1. An entity records a new machine at the cash equivalent price paid. ANSWER: ANSWER: PROBLEM 6-11 DISCUSSION (IAA) 2. A large entity decides that whenever an asset has a cost of less than P10,000, the cost will be charged Indicate the accounting concept that is the most to expense even though the asset may benefit applicable. several accounting periods. 1. Timely financial information with predictive and ANSWER: confirmatory value is presented. ANSWER: 3. The entity allocates the cost of a patent to the accounting periods in which it helps to produce the revenue. 2. Error-free financial information is presented. ANSWER: ANSWER: 3. The same accounting policies are applied from 4. The entity estimates and records interest expense period to period. on a 5-year noninterest-bearing not payable. ANSWER: ANSWER: 4. Notes to financial statements are prepared in order 5. Subscriptions received in advance by a magazine to have a fair presentation. publishing entity are treated as deferred revenue until the magazines are published. ANSWER: ANSWER: 5. The annual depreciation is recognized. 6. Users have trouble making interperiod comparisons ANSWER: when an entity changes accounting principles from one year to the next. 6. An allowable exception to the point of sale is the recording and reporting of inflows at the end of ANSWER: production. ANSWER: 7. Many users of financial statements prefer accounting principles such as accelerated depreciation that tend to state income on the "low 7. All repair tools are expensed when purchased even side". if the useful life is more than one year. ANSWER: ANSWER: 8. A patent is capitalized and amortized over the period benefited. ANSWER:Problem 6-7 Multiple choice (IAA) 1. Asset measurements in financial statements a. Are confined to historical cost b. Are confined to historical cost and current cost c. Reflect several financial attributes d. Do not reflect exit value 2. Which of the following should be considered a current value measure? a. Replacement cost and exit value b. Replacement cost and discounted cash flow c. Exit value and discounted cash flow d. Replacement cost, exit value and discounted cash flow 3. The primary measurement basis is a. Historical cost b. Fair value c. Value in use d. Current cost 4. Which measurement basis is currently used in financial statements? a. Present value b. Present value and settlement value c. Settlement value and fair value d. Present value, settlement value and fair value 5. Which measurement attribute is the most relevant? a. Present value b. Exit value c. Current cost d. Historical cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts