Question: Problem 6-70 Future Value and Multiple Cash Flows [LO1] An insurance company is offering a new policy to its customers. Typically, the policy is bought

![Problem 6-70 Future Value and Multiple Cash Flows [LO1] An insurance](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe45a0735f6_00066fe45a014784.jpg)

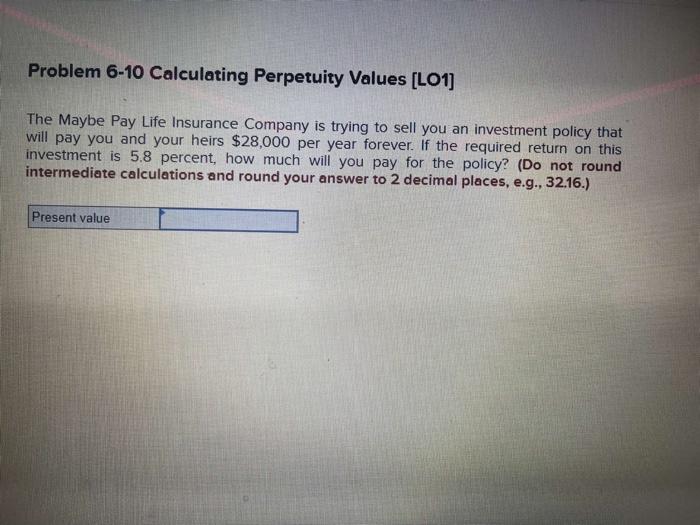

Problem 6-70 Future Value and Multiple Cash Flows [LO1] An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company First birthday Second birthday: Third birthday Fourth birthday Fifth birthday Sixth birthday $ 810 $ 810 $ 910 $ 850 $ 1,010 $ 950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $310,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Future value Problem 6-10 Calculating Perpetuity Values (LO1] The Maybe Pay Life Insurance Company is trying to sell you an investment policy that will pay you and your heirs $28,000 per year forever. If the required return on this investment is 5.8 percent, how much will you pay for the policy? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts