Question: Problem 6-8A Income statement comparisons and cost flow assumptions-perpetual LO2, 3 During 2020, Fresh Express Company sold 2,420 units of its product on September 20

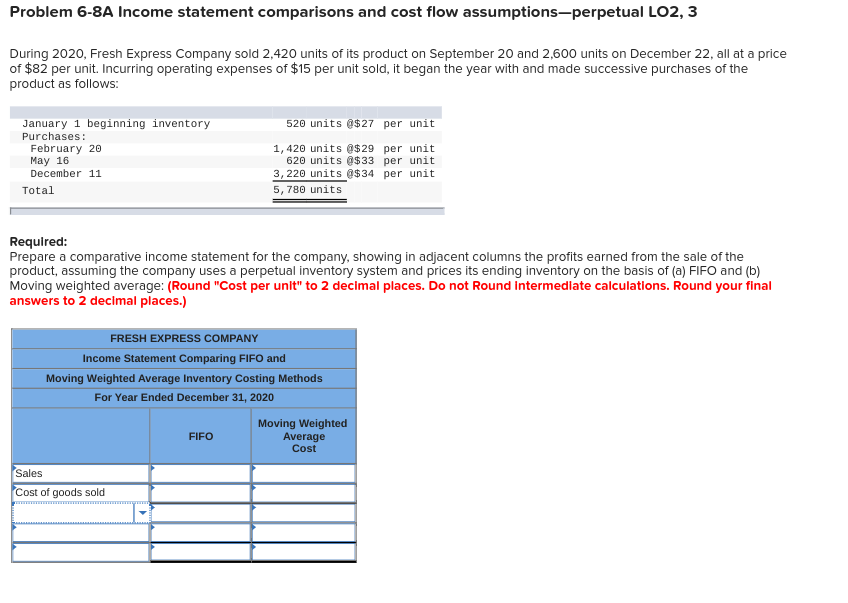

Problem 6-8A Income statement comparisons and cost flow assumptions-perpetual LO2, 3 During 2020, Fresh Express Company sold 2,420 units of its product on September 20 and 2,600 units on December 22, all at a price of $82 per unit. Incurring operating expenses of $15 per unit sold, it began the year with and made successive purchases of the product as follows: January 1 beginning inventory Purchases: February 20 May 16 December 11 Total 520 units @$27 per unit 1,420 units @$29 per unit 620 units @$33 per unit 3,220 units $34 per unit 5,780 units Required: Prepare a comparative income statement for the company, showing in adjacent columns the profits earned from the sale of the product, assuming the company uses a perpetual inventory system and prices its ending inventory on the basis of (a) FIFO and (b) Moving weighted average: (Round "Cost per unit" to 2 decimal places. Do not Round Intermediate calculations. Round your final answers to 2 decimal places.) FRESH EXPRESS COMPANY Income Statement Comparing FIFO and Moving Weighted Average Inventory Costing Methods For Year Ended December 31, 2020 FIFO Moving Weighted Average Cost Sales Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts