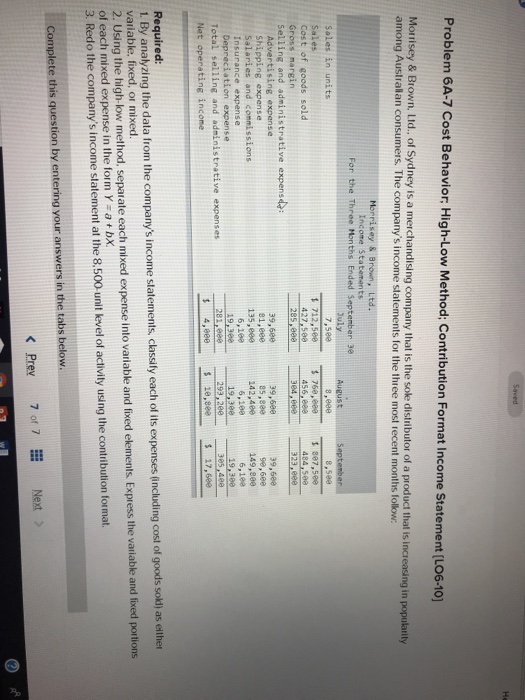

Question: Problem 6A-7 Cost Behavior: High-Low Method; Contribution Format Income Statement (L06-10) Morrisey & Brown, Ltd, of Sydney is a merchandising company that is the sole

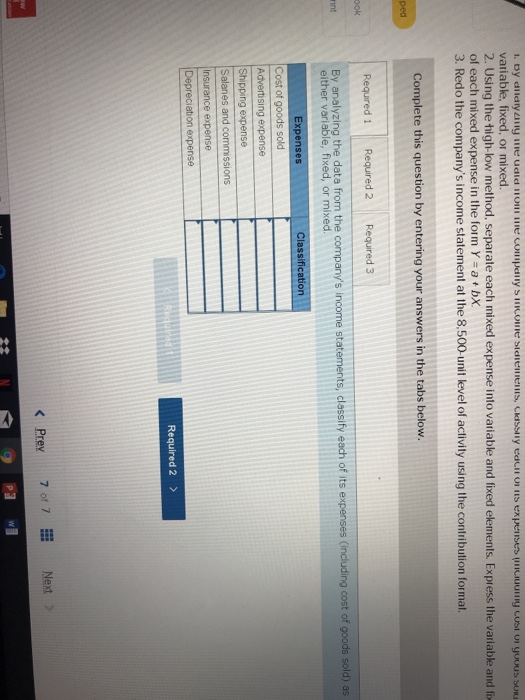

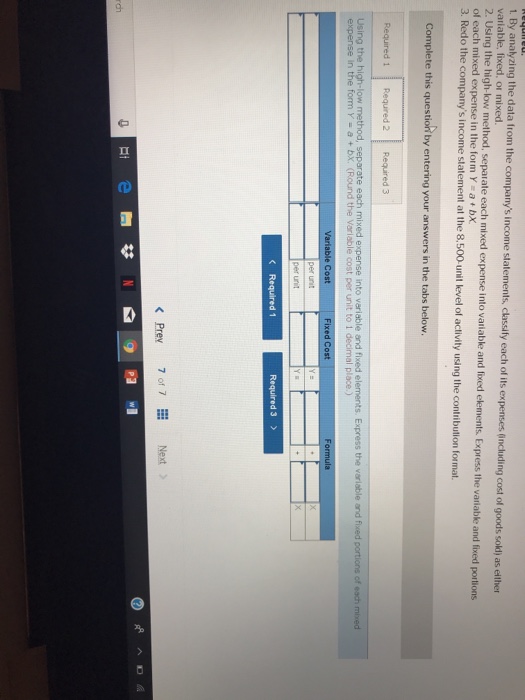

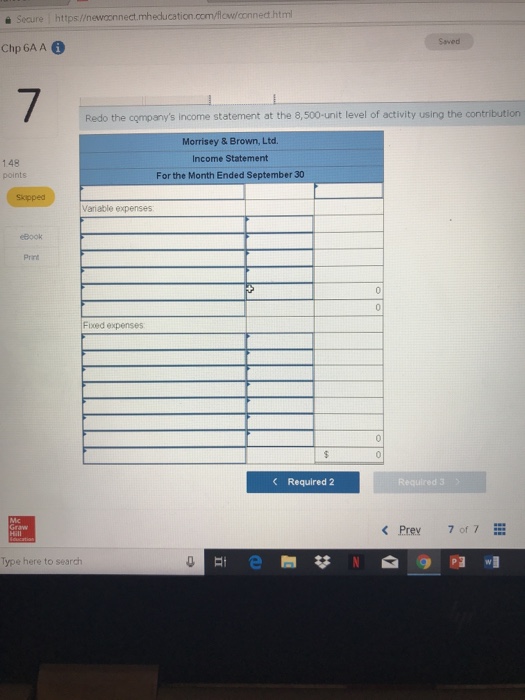

Problem 6A-7 Cost Behavior: High-Low Method; Contribution Format Income Statement (L06-10) Morrisey & Brown, Ltd, of Sydney is a merchandising company that is the sole distributor of a product that is increasing in popularity among Australian c The company's income statements for the three most recent months follow For the Three Months Ended September 38 39,608 81,8ee 135,eee 39.590 8s,see 142,480 1. By analyzing the data from the company's income statements, classify each of its expe nses (ncluding cost of goods sold) as either variable, fixed, or mixed 2. Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form -a t b). 3. Redo the company's income statement at the 8.500-unit level of activity using the contribution format Prev7 of 7Next>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts