Question: Problem 7 - 1 1 Child and Dependent Care Credit ( LO 7 . 2 , 7 . 3 ) Clarita is a single taxpayer

Problem

Child and Dependent Care Credit LO

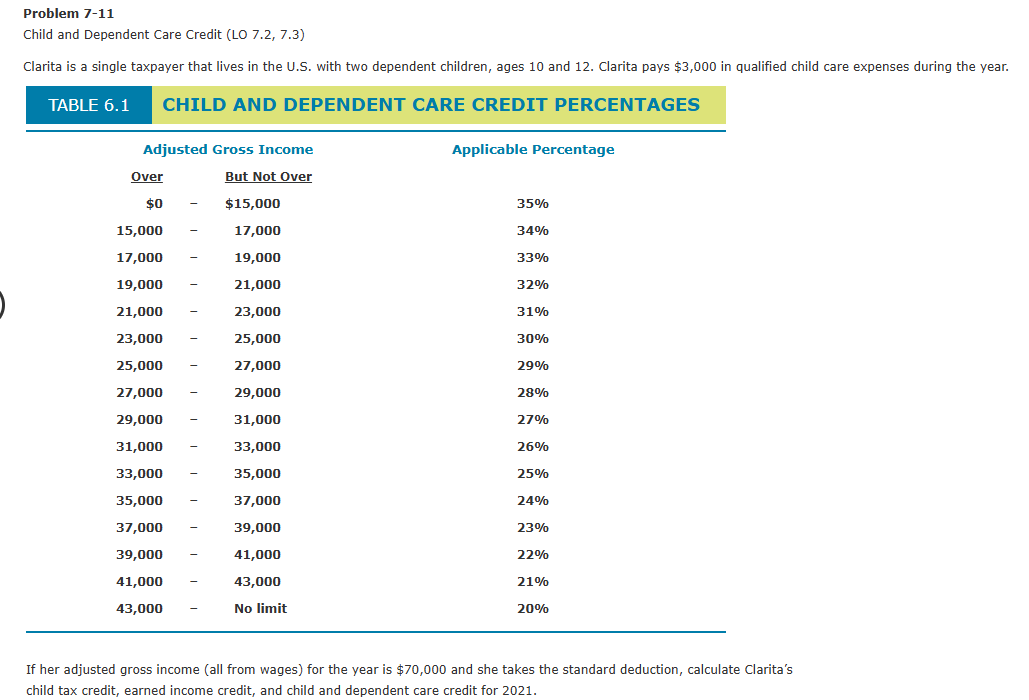

Clarita is a single taxpayer that lives in the US with two dependent children, ages and Clarita pays $ in qualified child care expenses during the year.

CHILD AND DEPENDENT CARE CREDIT PERCENTAGES

If her adjusted gross income all from wages for the year is $ and she takes the standard deduction, calculate Clarita's child tax credit, earned income credit, and child and dependent care credit for

Clarita's taxable income is $

with a tax liability precredit

of $

Her credits are computed below:

Child Tax Credit

$

Child and dependent care credit

$

Earned income credit

$

The total refundable credits equal

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock