Question: Problem 7 - 1 9 ( LO . 2 ) Carla was the owner of vacant land that she was holding for investment. She paid

Problem LO

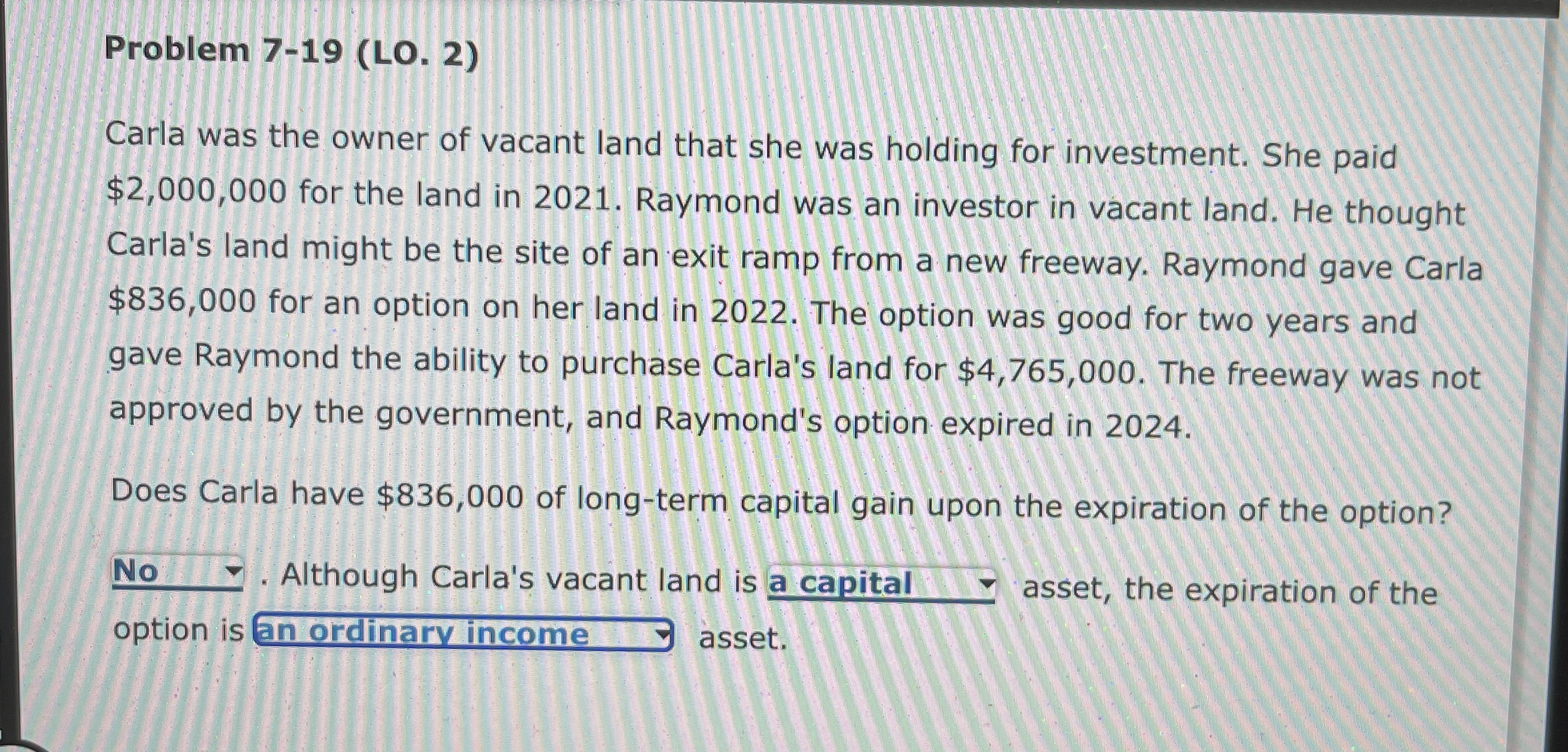

Carla was the owner of vacant land that she was holding for investment. She paid $ for the land in Raymond was an investor in vacant land. He thought Carla's land might be the site of an exit ramp from a new freeway. Raymond gave Carla $ for an option on her land in The option was good for two years and gave Raymond the ability to purchase Carla's land for $ The freeway was not approved by the government, and Raymond's option expired in

Does Carla have $ of longterm capital gain upon the expiration of the option?

Although Carla's vacant land is asset, the expiration of the option is asset.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock