Question: Problem 7 (14%). A special manufacturing machine will cost 500,000 TL now. Salvage value will be 100.000 KD after 5 years. a) Determine annual Straight-Line

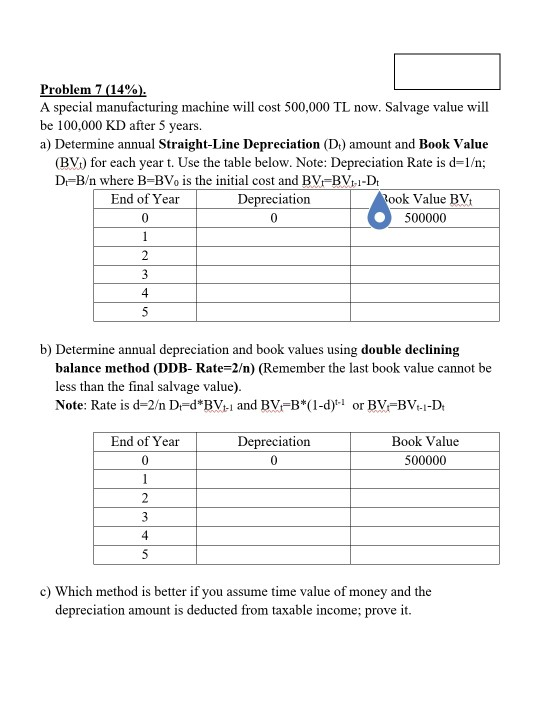

Problem 7 (14%). A special manufacturing machine will cost 500,000 TL now. Salvage value will be 100.000 KD after 5 years. a) Determine annual Straight-Line Depreciation (D) amount and Book Value (BV:) for each year t. Use the table below. Note: Depreciation Rate is d=1; D=B where B=BV, is the initial cost and BV-BV-1-D End of Year Depreciation Book Value BV 0 0 500000 2 3 4 5 b) Determine annual depreciation and book values using double declining balance method (DDB-Rate=2) (Remember the last book value cannot be less than the final salvage value). Note: Rate is d=2 D=d*BVt-1 and BV=B*(1-d)t- or BV=BV-D End of Year 0 Depreciation 0 Book Value 500000 2 3 4 5 c) Which method is better if you assume time value of money and the depreciation amount is deducted from taxable income; prove it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts