Question: Problem 7 . 2 1 Accounting for transactions with several journals Non - GST version Elliott started business on 1 July 2 0 2 5

Problem

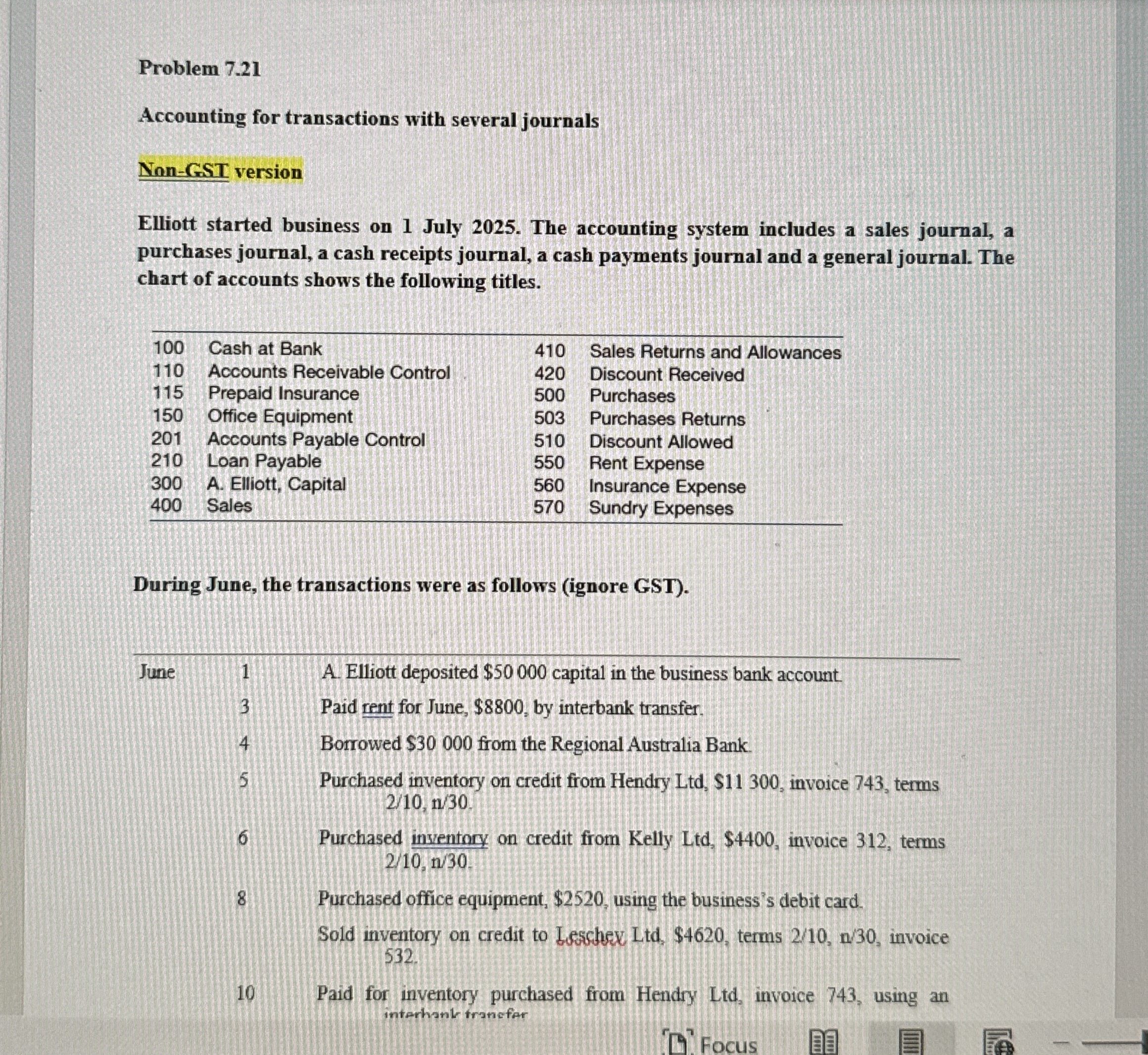

Accounting for transactions with several journals

NonGST version

Elliott started business on July The accounting system includes a sales journal, a purchases journal, a cash receipts journal, a cash payments journal and a general journal. The chart of accounts shows the following titles.

tableCash at Bank,Sales Returns and AllowancesAccounts Receivable Control,Discount ReceivedPrepaid Insurance,PurchasesOffice Equipment,Purchases ReturnsAccounts Payable Control,Discount AllowedLoan Payable,Rent ExpenseA Elliott, Capital,Insurance ExpenseSales,Sundry Expenses

During June, the transactions were as follows ignore GST

tableJuneA Elliott deposited $ capital in the business bank account.Paid rent for June, $ by interbank transfer.Borrowed $ from the Regional Australia Bank.tablePurchased inventory on credit from Hendry Ltd $ invoice terms

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock