Question: Problem 7 - 2 5 You wish to retire in 1 4 years and currently have $ 7 0 , 0 0 0 in a

Problem

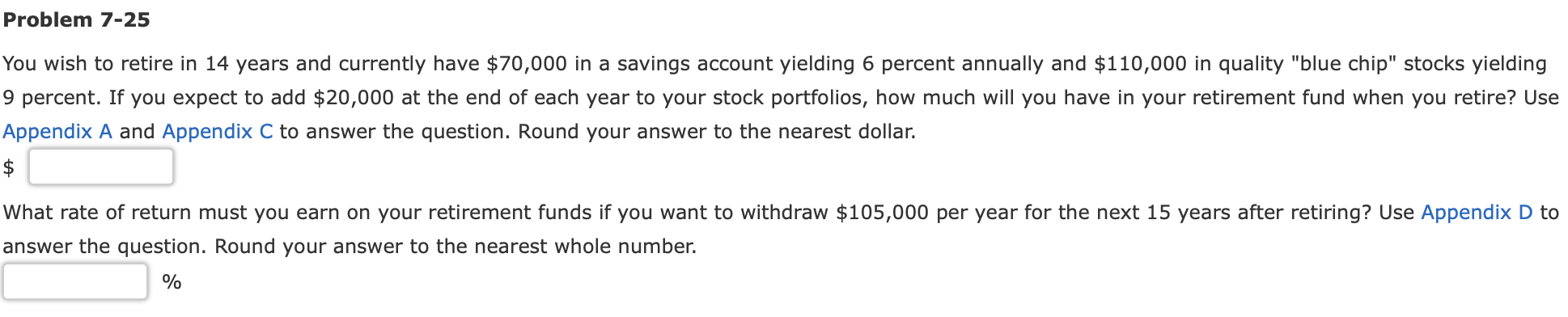

You wish to retire in years and currently have $ in a savings account yielding percent annually and $ in quality "blue chip" stocks yielding

percent. If you expect to add $ at the end of each year to your stock portfolios, how much will you have in your retirement fund when you retire? Use

Appendix A and Appendix to answer the question. Round your answer to the nearest dollar.

$

What rate of return must you earn on your retirement funds if you want to withdraw $ per year for the next years after retiring? Use Appendix to

answer the question. Round your answer to the nearest whole number.

I dont want an excel format answer. I want the formula.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock