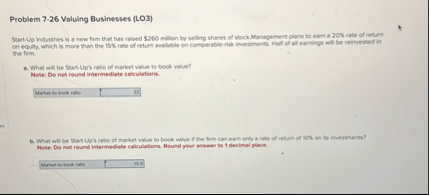

Question: Problem 7 - 2 6 Valuing Businesses ( LO 3 ) the frm . a . What wal be Shan - Up's ratio of market

Problem Valuing Businesses LO the frm

a What wal be ShanUp's ratio of market value is book value?

Nefe: De net reund imermediate calculations.

Mekeh whiva runs Nofer De not round intermediate saliculations. Round your arower tie decimal place.

Meral tollowion tabo

Problem Nonconstant Growth LO

You expect a share of tock pary dividends of $$$ and $ in each of the neat years. Wou beeleve the stock will sell for $ at the end of the third year.

a What is the stock price it the dicount rate for the stock is

Note: De net round intermedigte calculatijns. Aound your answer ho decimal places.

Sock price

b What is the devidend yeld for year it

tivilely reat

C What wai bee the dividend yoid at the stant of Fear

Notes Des net reund intermediate calouletiona. Enter pour anower as a percent rounded decimal pleces.

Problem Growth Opportunities LO earnings this your are $ per thare. Complete the following liblie. declimal phaces.

tableHivetara Batip,Orvwn Rate,Bueck Priet,Pre NatieNbDSE,NN

Problem Nonconstant Growth LO

You expect a share of stock to pay dividends of and in each of the neat years. Wju believe the stock wall sell for at the end of the thind yese.

a What is the stock price if the discount rate for the stock is Note: De not round intermediate calculations. Aound your anower to decimal places.

Stork price

b What is the doviend ywid for year

Note: Do net round intermediate calculations. Imer your answer as a perceent reunded lo decimal places.

Devidered reled

BC

c What we be the avidend yledd at the stal of year at

Aefer Dop not mound intermediate calculetiona. Enter your ansmer as a pereent rounded io a decimal places.

Deviend plete

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock