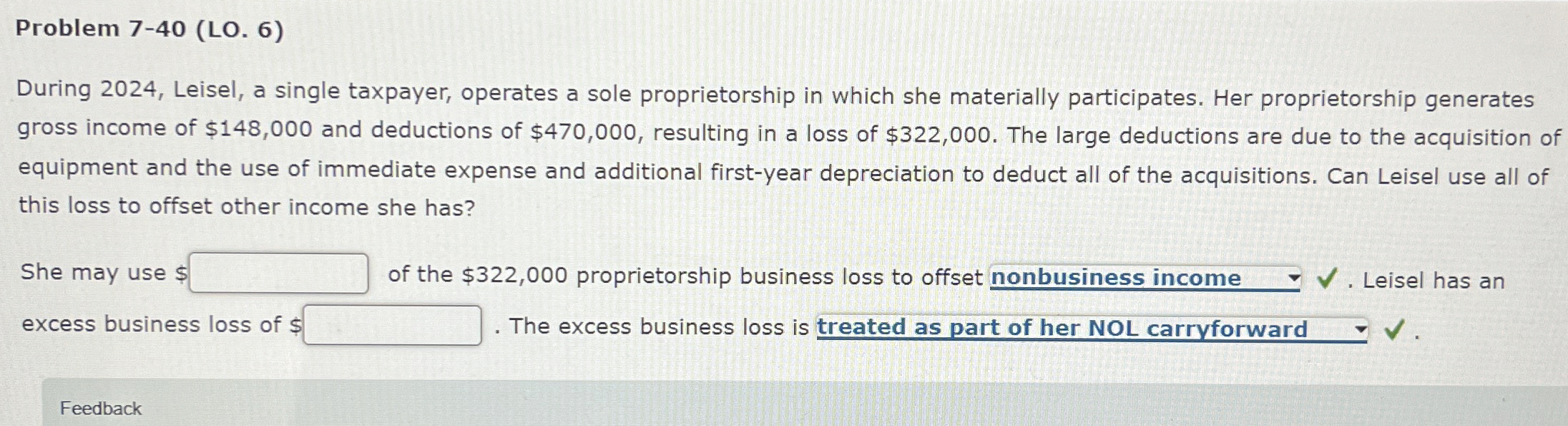

Question: Problem 7 - 4 0 ( LO . 6 ) During 2 0 2 4 , Leisel, a single taxpayer, operates a sole proprietorship in

Problem LO

During Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates

gross income of $ and deductions of $ resulting in a loss of $ The large deductions are due to the acquisition of

equipment and the use of immediate expense and additional firstyear depreciation to deduct all of the acquisitions. Can Leisel use all of

this loss to offset other income she has?

She may use

of the $ proprietorship business loss to offset nonbusiness income Leisel has an

excess business loss of $

The excess business loss is treated as part of her NOL carryforward

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock