Question: Problem 7 - 4 2 ( Algorithmic ) ( LO . 3 , 5 ) Through a Type C reorganization, Springer Corporation was merged

Problem AlgorithmicLO

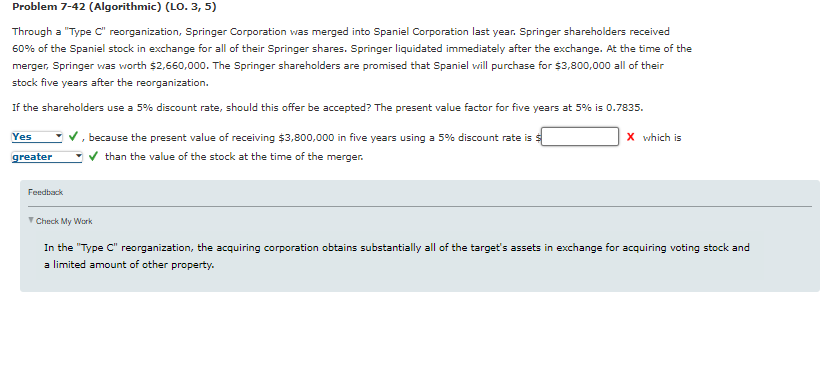

Through a "Type C reorganization, Springer Corporation was merged into Spaniel Corporation last year. Springer shareholders received

of the Spaniel stock in exchange for all of their Springer shares. Springer liquidated immediately after the exchange. At the time of the

merger, Springer was worth $ The Springer shareholders are promised that Spaniel will purchase for $ all of their

stock five years after the reorganization.

If the shareholders use a discount rate, should this offer be accepted? The present value factor for five years at is

because the present value of receiving $ in five years using a discount rate is $

X which is

than the value of the stock at the time of the merger.

Feedtack

Check My Work

In the "Type C reorganization, the acquiring corporation obtains substantially all of the target's assets in exchange for acquiring voting stock and

a limited amount of other property.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock